- Home

- >

- Market Rumours

- >

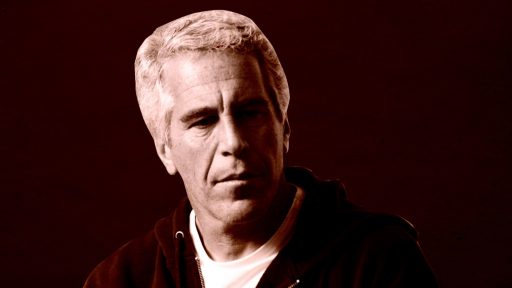

- Jeffrey Epstein’s dark fortune and his lackluster relationship with Glenn Dubin’s daughter

Jeffrey Epstein's dark fortune and his lackluster relationship with Glenn Dubin's daughter

Celina Dubin, 24, is the daughter of Miss Sweden, Eva Andresson Dubin, and the billionaire hedge fund manager, Glenn Dubin. Jeffrey Epstein met with Eva, who married Glenn for 11 years, in 1994. Epstein rests with an unclean conscience, an accused pedophile, but admits in his latest testimony that he intended to marry Celina - in 2014 she was then at 19. She called him "Uncle Jeff". No evidence was ever found that Epstein had a romantic affair with Celina, much as his intentions were purely financial. Epstein told his partners that he wanted her to inherit his wealth, including his private Caribbean island, and marriage to her would be a way to avoid inheritance fees.

In 2014, Epstein mentions Celina as a beneficiary of a trust fund. In 2015, she was abolished, claiming that the girl's parents were unaware of the fund. It is not clear how much money was in Celina's fund while it was a beneficiary, but according to 2019 figures, it was about $ 50 million.

In August this year, Business Insider revealed that the Dubin family had been financially, socially and philanthropically involved with Epstein for decades. In 2009, J.E. was released from prison after accusations that he was inciting children to prostitution, at which time Celina's family wrote a letter to the inspector who followed Epstein's probation that they "100% agreed" to spend time with him, who at the time was However, after Epstein's arrest in July, the Dubin family has publicly distanced himself from him.

The existence of this fund and Epstein's intentions to leave his inheritance to Celina shows that his relationship with his family was much more complicated than originally thought.

In August, Epstein commits suicide. The investigation returns in 2004 asking why this fund was created. The main reason for creating such a fund is precisely to reduce or avoid specific taxes. He transferred the ownership of the fund from JPMorgan to Deutsche Bank in 2013. The amount in the fund was about $ 50 million, detected in 2019, or nearly 10% of Epstein's total declared stock.

The fund was used to make payments to specific women in Jeffrey's circle. Six people were mentioned as beneficiaries and two trustees. One of those individuals was New York-based accountant Harry Beller and Virginia-based lawyer Erika Kellerhals.

However, Celina was removed from the fund in 2015 and has never received any money from it. The other beneficiary women were young models, girlfriends, pilots, lawyers, and in 1980 - Eva Andresson Dubin herself. According to Epstein, two of the girls married in 2013 so that the second Eastern European partner could obtain US citizenship. None of these women made public statements because they may have been victims of sexual abuse or trafficking in human beings.

Other sources familiar with Epstein's personal finances tell B.I. that he also used other trusts and accounts held by Deutsche Bank. Thus, he transferred money between people in his environment, including women who were victims of trafficking or organized such channels. In recent years, he appears to have been sending money to a number of women in Russia who were models.

In 2018, Deutsche Bank ends its relationship with Epstein. By closing and keeping accounts, it turns out that most of the $ 50 million in Celina's trust fund have been transferred to another Epstein account at FirstBank Puerto Rico.

It remains unclear whether the 2004 fund continues to exist. However, according to investigators, the fund is likely fully active in protecting the assets of Epstein from the 26 women who have sued, claiming to be victims of long-term trafficking. According to the lawyers, the victims may be able to find a way to get whatever money they have left, and they could end up with tens of millions of dollars if the lawyers find them.

In mid-November, a request was made to set up a fund to compensate victims of Epstein's atrocities. The institution will be overseen by lawyer Jordana Feldman and mediator Kenneth Feinberg. In this way, the prosecutors would dismiss their claims. Earlier this month, lawyers asked for a "fast track" to set up the fund.

Arick Fudali, a lawyer at Bloom Firm who represents five of Epstein's victims, says the mere existence of the 2004 trust fund raises the question of what exactly is in Epstein's wealth. Arick thinks there may be a conflict of interest, since J.E.'s wealth managers - Kahn and Indyke's lawyers were beneficiaries of the fund, at least until 2014.

Source: Business Insider Prime

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.