- Home

- >

- Great Traders

- >

- Jesse Livermore – Speculator King

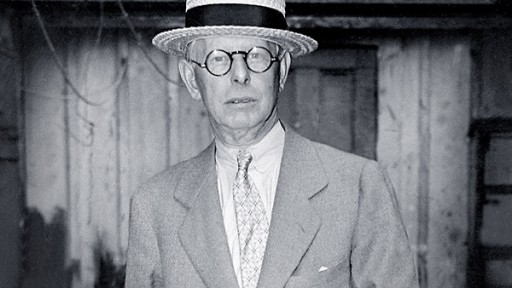

Jesse Livermore – Speculator King

Jesse L. Livermore is a legendary stock trader and one of the success models that helped with the development and popularization of stock trading as a whole. He was nicknamed "boy plunger" at an early age due to his aggressive risk taking through large stock trades. His claim to fame was amassing fortunes on Wall Street during the crash of 1929. Even through all his successes trading the stock market, Livermore was unfortunately also known to have a difficult time maintaining personal relationships and ultimately lost his entire fortune.

In his early teens, Livermore left home to escape a life of farming. He went to Boston and started his long career in stock trading by posting stock quotes for the Paine Webber brokerage firm.

He then began trading for himself and by the age of fifteen, he had reportedly produced gains of over $1,000, which was big money in those days. Over the next several years, he made money betting against the so-called "bucket shops," which didn't handle legitimate trades - customers bet against the house on stock price movements.

He did so well that he was banned from all of the shops in Boston, which prompted his move, at age 20, to New York where his speculative trading successes - and failures - made him a celebrity on Wall Street and around the world. His financial ups and downs finally ended tragically with his suicide death at the age of 63.

Jesse Livermore had no formal education or stock trading experience. He was a self-made man who learned from his winners as well as his losers. It was these successes and failures that helped cement trading ideas that can still be found throughout the market today.

His career was impressive and fascinating; he started off as a board boy in the gambling industry only to end up becoming Wall Street's most influential trader fifteen years later. By the age of 15, Jesse Livermore had already made $1000 (a rather important amount of money for 1890) by investing in the stock market solely through hunches and assumptions.

Livermore is widely known to have made no less than $3,000,000 in one day during the financial market meltdown of October 1929, crashing the market into oblivion by short-selling stocks.

Enjoying a very lavish lifestyle and reportedly being very unstable both mentally and professionally, Jesse Livermore had in fact gone bankrupt and broke three times in his career. He made an immense fortune right before the great depression, but also lost money with ease. He owned several mansions around the world, fully staffed with servants and a fleet of limousines and he was quick to renounce his life partners for new women he met. In a moment of despair and depression, he shot himself dead in a hotel room in Manhattan. He left behind $5,000,000 worth of cash, assets and stock and a good bye note addressed to his third and last wife. Ironically, she herself had married four times before to husbands who all committed suicide.

$100 million - Jesse Livermore was worth that amount of money at the peak of his career in 1929. In today's money that would be close to $13.7 billion.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.