- Home

- >

- Stocks Daily Forecasts

- >

- Jim Cramer: Don’t get shaken out of good stocks

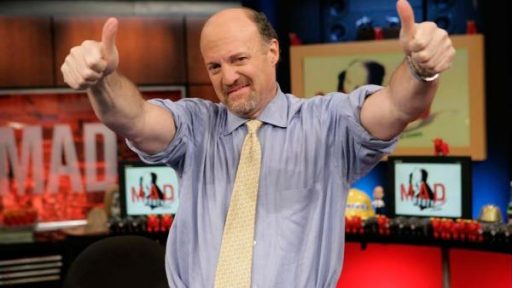

Jim Cramer: Don't get shaken out of good stocks

Buying high and selling low is a time-honored way of losing money, Jim Cramer reminded his Mad Money viewers Wednesday. Too often, investors get shaken out of great stocks for all of the wrong reasons. That's because there's a big difference between trading and investing.

If you were looking to invest in some nice pants at your favorite retailer, you'd probably wait for them to go on sale. The bigger the sale, the happier you'd be and the more pairs you'd consider buying. But in the stock market, investors run from falling share prices, instead of buying more as they head lower.

Trading is a different story, Cramer explained. Trading is event-driven and investors must look for a catalyst, a reason to buy. When the catalyst happens, it's time to sell. If the catalyst doesn't happen, you must sell as well, because trades should never become investments. Trading takes discipline.

True investors can learn a lot from the action in Apple (AAPL - Get Report) this week. Traders bought into Apple ahead of this week's iPhone event and sold on the news, as they should. Investors however, should not have been shaken by the analyst community calling the event a dud, as they have since the beginning of time. They should have been buying more on the weakness.

Over on Real Money, Cramer says trading the newest iPhone launch was foolish, but you can begin to invest now, if you use discipline.

Beauty may be in the eye of the beholder, but when it comes to beauty stocks, Cramer said some definitely look better than others. Everyone likes to look good, he reminded viewers, and with cameras getting better all the time, looking good is quickly becoming a necessity.

Cramer has been a long-time proponent of Ulta Beauty (ULTA - Get Report) , and said that this stock remains intriguing at its current levels. But then there are the cosmetic makers, Coty (COTY - Get Report) , Estee Lauder (EL - Get Report) and e.l.f. (ELF) .

Cramer said that Coty is not looking so hot as of late, as the brands the company bought from Procter & Gamble (PG - Get Report) have been slowing its growth. Estee Lauder meanwhile, is a permanent resident on the new-high list, as it continues to deliver stunning 7.5% organic growth. Shares are not cheap at 25 times earnings, but Cramer said they're certainly worth it.

In the Lightning Round, Cramer was bullish on Arconic (ARNC) , PetMed Express (PETS - Get Report) , Idexx Laboratories (IDXX - Get Report) and AbbVie (ABBV - Get Report) .

Cramer was bearish on Fitbit (FIT - Get Report) , Qualcomm (QCOM - Get Report) and Walgreens Boots Alliance (WBA - Get Report).

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.