- Home

- >

- Stocks Daily Forecasts

- >

- Jordi Visser: The bottom for EM stocks is near

Jordi Visser: The bottom for EM stocks is near

Jordi Visser, a hedge fund manager, became known for his warning in January that it is likely that this year we will see a massive sell-off in EM assets. His prediction, of course, proved to be true. Today, the official MSCI EM Index, which tracks stocks from emerging economies (mainly from East Asia), has officially entered а bear market: since the beginning of the year, the index has fallen by 20%.

Now, more than half a year after his warning, financial markets are panicking and selling-off just about everything related to emerging markets. In July, money flows in emerging markets were$ 13.7 billion; in August they were only $ 2.2 billion.

According to Visser, the end of the bear market is coming soon. For him, a signal for the end of the bear market will be the policy of the Federal Reserve: if Powell and the Federal Reserve slow down their tightening, the end of the bear market in the shares of emerging economies will be near

At this stage, in the long run, emerging market shares offer attractive opportunities. But no investor wants to "lie under a falling knife" before he sees clear signs of stabilization.

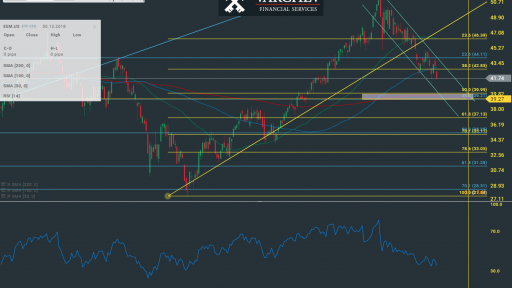

Technical picture: MSCI EM Index (EEM.US)

Weekly chart

The price of the index broke the Fibonacci support between $ 42 and $ 44, a Fibonacci cluster. If the price remaiins in the current downward channel, we expect further support around $ 39 (where Fibonacci clusters will support it). If the downward trend does not accelerate or slow, and the price remains in the current channel, support is likely to be reached by the end of the year.

Currently, however, the technical picture for the index is bearish without significant support in the current price zone. The weakening in the dollar or an aggressive tightening policy by the Federal Reserve is a fundamental signal for reversing the trend in the index.

Source: Bloomberg Finance L.P.

Chart: Used with permission of Bloomberg Finance L.P.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.