- Home

- >

- Great Traders

- >

- Joseph Ritchie – one of the best traders

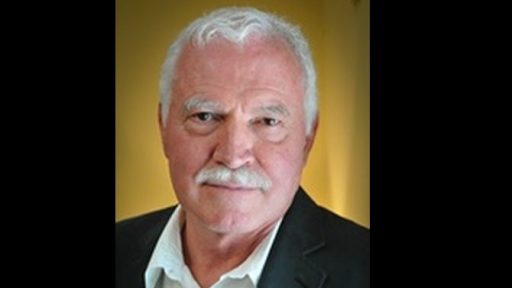

Joseph Ritchie - one of the best traders

Joseph Ritchie (born 1947) is a trader of options and commodities, international businessman, presidential adviser, serial entrepreneur, aviator and the father of ten children. In 1977 he founded Chicago Research and Trading (CRT) and currently serves as head of the Fox River Partners. According to BusinessWeek, "Richie is widely recognized as one of the sharpest minds in the business of options." Ritchie attended Wheaton College, where he studied philosophy. After graduation he worked as a bus driver for the Chicago Transit Authority. Later Ritchie worked as a prison guard Cook County. While there, a friend changed his life, giving him a book on how to become rich through trade with aktsii.

In 1970, Ritchie became a programmer for Arthur Andersen. Just at Arthur Anderson is where he first met Steve Fossett project for Marshall Fields.

In 1976 Ritchie started working on the floor of the Chicago Board Options Exchange (CBOE). Weather in Ritchie CBOE was short, only two months, but here he programmed formula Black-Scholes in his Texas Instruments SR-52. This little use of technology has led to the huge success of the floor. Ritchie lost interest in trading stock options, and left the CBOE, but before he left, he gave his calculator Texas Instrument, which was programmed with the formula of Black- Scholes, Steve Fossett.

According to Richie, "a trader on the floor with the simplest programmed calculators in 1976 immediately became one-eyed man in the land of the blind." Fossett made a fortune using this calculator and became the single largest trader on the floor of the CBOE. Later Faucet awarded his success as a dealer Richie, in his book Chasing the wind.

Richie left the Chicago Board Options Exchange (CBOE) in 1976, and returned to trade futures in Chicago Board Of Trade (CBOT). Richie continues futures trading when he started Chicago Research and Trading (CRT). CRT is back in business with options when CBOT began trading options on futures.

Well known in the world of trading options is that Richie "... single revolutionized the market for options." In early 1980, Richie determined that the pricing model of Black- Scholes is incomplete. He realized that the model is missing some critical data; Yet, he still has not revealed the changes made in the formula of Black-Scholes. Richie said: "It was like counting cards before casinos knew that counting cards existed."

Ironically, "By the end of 1990, financial academic icons Robert Merton and Myron Scholes are treated in their homes by a Nobel Prize for their contributions to the pricing of stock options. At this time, however, Joe Ritchie and his company, Chicago Research and Trading, are treated at home over 1 billion. dollars in trading profits, thanks to his own mastery of market options and for a decade and a half earlier, he was able to understand that these famous financial engineers and their models for pricing options are far from the truth. "In an interview in the mid-1980s, Ritchie was asked what he would say scientists who claim that markets are efficient? Richie replied, "Well, I do not want to discourage them. Let him think. They will learn, I will trade."

CRT was also one of the first computerized theory to assess the options while have introduced computer-driven trading strategies. In 1985, Institutional Investor Magazine said "CRT ride wave of heady gains, thanks to computer-driven trading strategies." CRT capacity to evaluate options far right has allowed them to narrow the spread bid / ask market options. In 1988, The Wall Street Journal writes that "the secret of the CRT is a computer system that uses one of the most complex business models in the field of securities. By observing the differences in the prices of options and futures, with the model developed mainly by Mr. Ritchie, the company performs more than $ 2.5 billion US dollars in transactions every day. "

Unique perspective Richie was introduced in every area of its business, from the way he looks at employees to unique investment strategies. Trader Monthly said of Ritchie: "Joe's ability to look ahead not just for six months but for several years, is second to none." This perspective helps to see the goods and shares that are undervalued, but it also explains its ability to recognize people who have been underestimated.

After the sale of CRT in 1993 to Nations Bank (now Bank Of America), Ritchie used the same model as the investment manager of Fox River Partners LLC (originally Fox River Financial Resources). Fox River operates primarily in investments of hedge funds and private equity. Known business ventures include Hollywood Sign (2010) and Hana Hotel and Ranch in Maui (2001)

Varchev Finance

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.