- Home

- >

- Cryptocurrencies / Algotrading

- >

- JP Morgan presents “JPM Coin” – the first cryptocoin from a large bank

JP Morgan presents "JPM Coin" - the first cryptocoin from a large bank

The Wall Street giant, JP Morgan Chase, has launched its own cryptocurrency to increase the efficiency of cash settlements.

According to a CNBC report, the coin will be called "JPM Coin" and is still in development, but the bank is preparing to start the first experiments with its new digital asset within a few months.

Umar Farooq, head of Blockchain's bank projects, commented to CNBC: "Everything that exists in the world now moves into the world of blockchain, including payment methods and transactions." The apps are actually endless, all about moving some information , the storage and validation of data between corporations and institutions can be transformed into blockchain mechanisms. "

In the beginning, the tokens will be used to close a small portion of customer transactions, especially in business, and in real time. Mostly, only the large institutional clients of the bank, with regulatory access, will have the opportunity to use the pipe.

JPM Coin will be similar to the current stable coins, which will be equivalent to one dollar. The bank will provide the token when the customer makes a deposit, and once the tokens are used for some purchase or transaction in securities in the blockchain environment, the bank will destroy the token by returning the token value versus the dollar back to one.

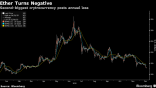

JP Morgan, and especially the CEO of the bank, Jamie Dimon, do not have a good story with Bitcoin. He publicly expressed a negative opinion about digital currencies that they are a scam. He even compared Bitcoin with the famous "tulip bulbs" that created a bubble, adding that: "It will not finish well, some will lose a lot."

Source: Finance Magnates

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.