- Home

- >

- Stocks Daily Forecasts

- >

- JPM dramatically lowers China’s GDP expectations! What to expect?

JPM dramatically lowers China's GDP expectations! What to expect?

After the latest tariff update by the US and China, the situation looks like this:

-

- The total customs rate on imports of all Chinese goods to the US reached 20.4%

- Imports of US goods to China reached 18.8%.

What the numbers mean?

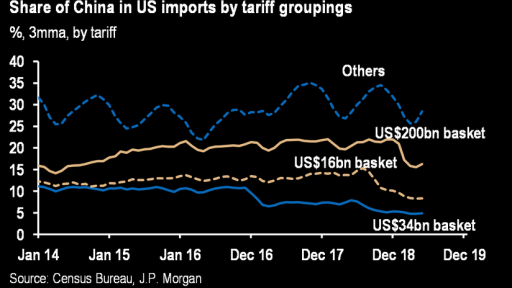

According to Emerging Market Research Team of J.P. Morgan, "Tariff increases will not be essential to China's economic performance in 2019, but 2020 is likely to be catastrophic." At first glance, a loud statement, but the chart below eloquently shows the decline in Chinese imports to the United States.

What to expect?

To some extent, this decrease is already accumulated in Chinese stock prices, but before we make long-term investments, we must not forget a few things! Even as we witness a trade deal in the coming months, the effects of the duties already imposed will only begin to worsen China and, to some extent, the US. From a trader's perspective, it's better to focus on more secure markets, such as the United States and partial portfolio hedging.

In terms of markets in China and the region, it is good to distance ourselves until relations with the US, and especially the country's economic indicators, stabilize.

Let's look at the iShares China Large Cap ETF (FXI.US) - Weekly Chart

Currently, the price remains in very broad consolidation and in an area of support formed by an internal horizontal and 61.8% Fibonacci correction of the last uptrend. Given the negative economic data that is expected in the coming months, it is a good idea to keep an eye on it. The winning strategy here would be to leave the tool under control and, in the downside break, add to the short positions in order to reach the main diagonal, where to land the short ones and look for signals for long long positions.

Alternatively, if the price goes above 50% Fibonacci retracement and the main downside, the negative scenario will collapse and we are more likely to see an increase in the index price (ETF).

Source: Bloomberg

Chart: Used with permission from Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.