- Home

- >

- Stocks Daily Forecasts

- >

- JPMorgan predicts high volatility in 2019 and hard times for stocks

JPMorgan predicts high volatility in 2019 and hard times for stocks

JPMorgan Chase & Co expects Standard & Poor's 500 to rise by 18% by the end of 2019. But that does not mean things will develop smoothly. They recommend an additional hedge strategy in anticipation of increasing volatility on the road to climb.

In their monthly Asset-Allocation report of December 7, the strategists led by Nikolaos Panigirtzoglou recommended that the weight of the shares in the portfolios be reduced by 7% from the previous 9%. Cut raw materials to 0% of 3% and increase the available cache from -5% to 0%. Key government securities to 1% and bonds to -8%.

The Bank remains with a positive attitude in the battle between stocks and bonds, believing bond yields will continue to exceed the levels of consensus in 2019. These include the assumption that markets are at a time of transition where volatility causes significant market movements. Apart from diversification, JP recommends, in order to protect the portfolio from high volatility and build a structure of options across different asset classes that could benefit from the rise in volatility.

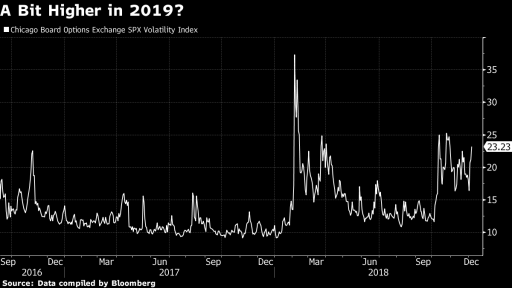

Volatility has soon shown its head more and more. The S & P500 is down about 10 percent of its record peak in September 20. Meanwhile, the CBOE Volatility Index (VIX) averaged 11.09% in 2017, and in 2018 by 16.03.

JPMorgan emphasizes inflation by predicting average VIX moving around 15-16 points in 2019, compared to an average of 14-15 points in 2018

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.