- Home

- >

- Daily Accents

- >

- JPMorgan predicts that even in the bad reporting season, the rally in the stock will continue

JPMorgan predicts that even in the bad reporting season, the rally in the stock will continue

The approaching reporting season turns out to be quite heavy, but that may not have been so negative on the stock market, which is still waiting for bad news. At least they think of JPMorgan Chase & Co.

Especially the weak economic activity shown by Europe's indicators suggests that the upcoming season will be a huge challenge and that the results will be below expectations. The Bank has reduced its EPS growth expectations in the region by 3% this year.

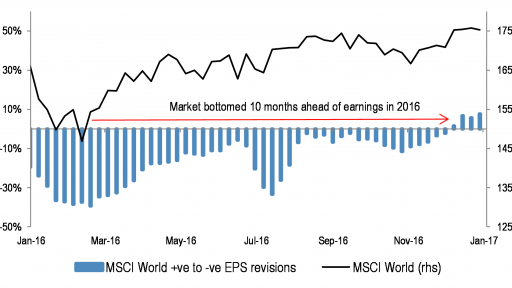

However, JP's Mislav Matejka still predicts European stocks to jump by as much as 10 percent by the end of 2019, which means that the stock market does not need additional growth in the bottom line to find a bottom. He sees similarities as in 2016, when the shares bottomed out in February, 10 months before the EPS revision became positive.

The strategist believes that investors are already prepared for disappointing results, given the already sharp drop in EPS values for Europe and the US in October - 8 and 9% respectively.

A break in Federal Reserve policy, a leap in the dollar as well as a stabilization of economic activity in the United States and China will in any case reinforce the ongoing rebound in bottom stocks, according to Matejka. He prefers US shares, as he suggests that they will show better reporting results than European ones.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.