- Home

- >

- FX Daily Forecasts

- >

- JPY bulls are receiving support from unexpected source

JPY bulls are receiving support from unexpected source

Yen bulls who were betting the Bank of Japan will edge away from monetary stimulus are basking in this month’s global stock slump, which has propelled the currency to the strongest in 15 months.

AMP Capital Investors Ltd.’s Nader Naeimi this week added to his long yen positions, wagering the currency will strengthen against the dollar, pound and Philippine peso among others.

“On Tuesday I reinstated the significant long yen positions against the Taiwan dollar, Singapore dollar, U.S. dollar, pound and Philippine peso. This is a trade with an excellent risk/reward on its own, as well as an valuable hedge against my exposure in cyclical equity sectors." said Naeimi.

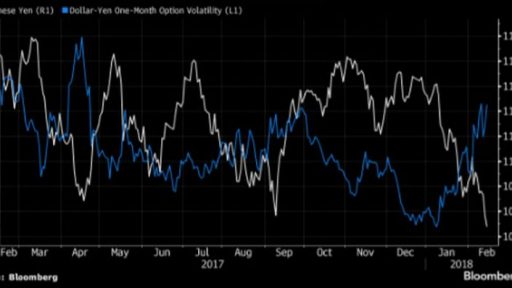

The yen has rallied against all its developed-market peers this month as the global stock rout that began in early February boosted haven assets. The currency is typically supported in times of market turmoil by the fact Japan runs a current-account surplus. The yen extended gains to 106.18 per dollar on Thursday, the strongest since November 2016, as Japan’s Finance Minister Taro Aso said the currency’s move wasn’t abrupt enough to require intervention.

Many yen bulls initially entered the trade predicting the currency would benefit as the Bank of Japan moves toward removing its record stimulus. The currency jumped more than 1 percent on Jan. 10 after the central bank cut purchases of longer-maturity bonds the day before. It held those gains even after Governor Haruhiko Kuroda took pains to stress the BOJ is still committed to its easing policy.

Source: Bloomberg Pro Terminal

Trader Bozhidar Arabadzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.