- Home

- >

- Cryptocurrencies / Algotrading

- >

- Key Bitcoin indicator is flashing for a Bull run coming

Key Bitcoin indicator is flashing for a Bull run coming

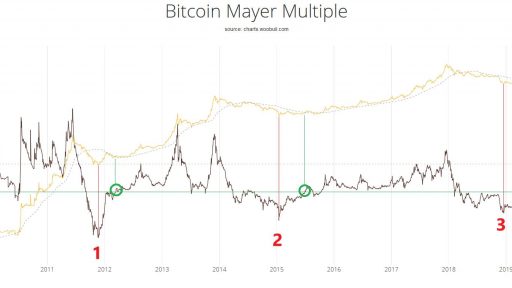

In the chart, the green circles represent the MM indicator moving above 1.0 signaling the establishment of a long-term bottom for bitcoin price $5279.50 +0.23%.

Going by this information, it appears another indicator is showing that BTC may have already bottomed out, marking the end of a bear market, which started in December 2017.

The MM indicator is a simple ratio of the price of Bitcoin to its 200-day moving average price. A low MM ratio is indicative of bear market periods. It suggests a trend reversal when the ratio reaches the 1.0 boundary point.

Historical patterns are usually an important aspect of deducing future BTC price action. In previous cycles, the MM moving above 1.0 marked the end of a Bitcoin market. This was followed by a period of consolidation leding up to the next bull-run.

The consolidation period is usually characterized by sideways price action signaling an accumulation phase. In 2012 and 2015 this period lasted six months and three months, respectively.

Given the recent BTC resurgence that catapulted the price above $5,000, many analysts have said the downward market trend has finally been broken.

As reported recently by Bitcoinist, Binance Research also found evidence to suggest that the market has already bottomed out.

For bitcoin investor Trace Mayer, 2021 could see Bitcoin go as high as $100,000 to $250,000. Many analysts say the upcoming 2020 halving will also create an additional tailwind for a more bullish upward lift based on historical precedents.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.