- Home

- >

- Fundamental Analysis

- >

- Key economical events for March

Key economical events for March

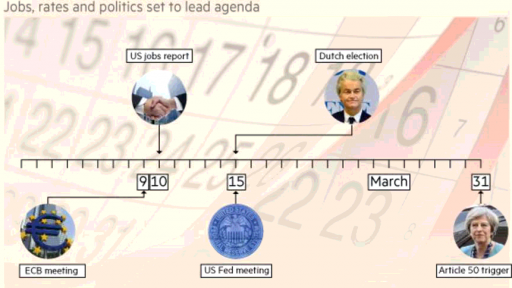

The first to months of 2017 will be marked with the storming of the risk assets, which heightened the optimism on Wall Street and sent the FTSE ALL-World Index in record zones. Is this rally going to be sustained during March really depends on some key factors. Here's a list with the most important events for the upcoming month:

U.S. jobs data and Federal Reserve

The positive sentiment on the financial markets mainly reflects the high hopes for the fiscal stimulus, promised by Donald Trump's administration. These moods were supported by the State's positive economical data, which only heightened investor's interest towards the upcoming data for Employment rate for February,due on the 10th of March, only days before the rate hike from Fed.

So far the U.S. market seemed positive on the prospect for a rate hike, seeing the tighter policy as a sign for a stronger economy, which will boost corporate profits. However, the last decline in Treasury yields shows, that investors are not completely sure that Fed will hike the inflation rates in mid March. The Fed's meeting will also show investors if they'll have to prepare for a more aggressive policy from Fed for 2017.

ECB and the stimulus question

Policymakers and investors in the euro zone will have to weight in the converging powers of the economical trust and political concern this month, as ECB are setting in for a meeting on 9th of March.

With the unemployment down, business confidence up and inflation, reaching the ECB's target for the first time in years many think, that the years of extraordinary economical stimulus are meeting their end.

The previous ECB decision to lower the monthly bond purchases from 80 to 60 billion euros from April is considered by some as the first step towards eventual withdrawal of quantitative easing.

However, the President of ECB, Mario Draghi was careful enough to note, that restore of the region needs to be consistent so it can change policy. Concerns stay for the neighbor countries Italy and Portugal.

It will be hard for the ECB to remove itself from the market, says David Owen, chief economist for Europe from Jefferies.

Article 50 and the GBP

Not so long ago, the formal start of the official negotiations for the UK's leave of EU was considered by many traders as a sign for the falling of the sterling.

Nevertheless, the well received speech from Theresa May lowered the pessimism from the event. The pound outlined a steady course, staying near the $1.24 zone thanks to the positive economical data, which can become even better with Trump's administration on board. The GBP's vulnerability was highlighted with this weeks report, that article 50 might coincide with the second referendum of the Scottish independence.

Even so, "we still think that the GBP will gain some momentum in the upcoming months, as many will take the opportunity to run away from the growing European political uncertainty", Lee Hardman, currency analyst at MUFG said.

Watch, but don't worry for Holland.

On 15 March, Dutch voters will go to the polls and will potentially provide the latest data on growing negative sentiment in Europe.

Geert Wilders, leader of the right Party for Freedom is leading in accumulation of votes, though he recently stopped his public appearances due to a safety issues. Joost Beamont, an ABM Amro analyst said, that there wasn't much of a change in investors behavior on the dutch covered bonds market, high quality long instruments, which are supported with mortgages and issued from the banks. Instead, risks lie in signals to wider audiences.

Europe's profit engine

Profit growth in one of the missing ingredients for European stocks. The long and hard period in the region dates back to the financial crisis, and the recovery depends on the change. From the drawn-out earnings season for the fourth quarter of 2016 there are signs of recovery.According to analysis from Morgan Stanley, 39 per cent of companies that have so far reported have beaten consensus estimates by 5 per cent or more, with 31 per cent missing, giving a net beat of 8 per cent.

If 2017 is to be the year that European equities start to close the gap with their record-breaking US peers, the remainder of earnings season in March will need to sustain the momentum. Earnings from a range of blue-chips over the coming weeks, including German exporters Merck and Adidas, Italian oil group ENI and Suez, the French utility, have the ability to break or make the thesis.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.