- Home

- >

- FX Daily Forecasts

- >

- Key levels for NZD/CAD will the long continue?

Key levels for NZD/CAD will the long continue?

FX forecast /NZD/CAD / Our expectations

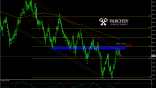

The mid-term trend remains long, and the temporary uncertainty surrounding the US-China trade war lead to pressure on risky currencies such as the NZD. In addition to the short-term retracement, the rising oil, which supports the Canadian. The main driving force here is the state of the Chinese economy and import tariffs that the US has announced to the country. It may sound a little cliché, but it's a common phenomenon on the Forex market, Selling Hearing and Buying Fact. What does this mean in this case? In short, I would like to say that the import tariffs announced by the United States against China are already accumulating at the cost of the New Zealander, with the technical analysis showing that the bulls are beginning to take precedence.

The price is in the mid-term upward movement and is currently at a level of horizontal and diagonal support, reinforced by 23.6% Fibonacci correction. 50 and 200SMA are beaten crossed, the price is close to the 50th period. The price forms a bullish pin bar at support levels that is activated and we are currently observing a test that gives us an extraordinary opportunity for Long from the current levels with shallow SL. In addition, DeMarker points up, still in a neutral zone.

SL: 0.93171

Alternative Scenario: If the price goes below the basic level of support and stays there in several successive bars, the positive scenario will be spoiled and the decrease will be more likely.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.