- Home

- >

- FX Daily Forecasts

- >

- Kudlow should stick with TV job. His call on dollar was terrific

Kudlow should stick with TV job. His call on dollar was terrific

I don't know what Larry Kudlow eats for breakfast ... but whatever it is, I'll take a big serving, please. “I would buy King Dollar and I would sell gold,” the former CNBC commentator said on March 14 after Trump named him economic adviser. That call has proven prophetic, even if it was a tad earl. The DXY has gained 3% over the past two weeks and gold lost about the same amount, just as many were writing the obituary of the U.S. currency. (h/t to Neil Dutta at Renaissance Macro for flagging.)

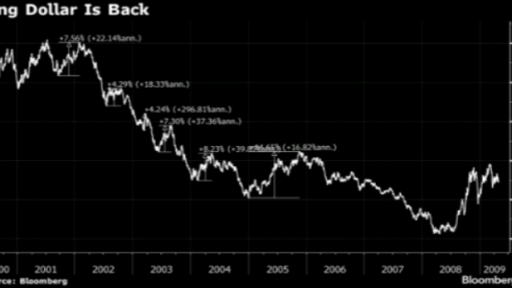

Now that the rebound has started, the question is how far the rally can run. Without stealing Kudlow's crystal ball, a quick glance at the DXY's chart identifies seven counter-trend rallies during the dollar's last bear market between 2001 and 2008. The gains varied from ~4% to ~15%, with the median at about 7%.

So far, the dollar has jumped about 4% from this year's low, meeting the minimum of the rebounds during the last bear market. It has some room to go to match the median gain. The fundamental driver for the dollar's recent gain seems to be a mini-decoupling as the U.S. economy outperforms the rest of the world. If data continue to support the theme, then the dollar rally could last a bit longer, as fellow blogger Mark Cudmore argued.

The dollar's fortune also depends on market positioning. It is unclear how short the dollar the market is. But it's probably fair to say the market isn't long, which would suggest some room to build the position, before the structural deficit story comes back to haunt it.

Source: Bloomberg Pro Terminal

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.