- Home

- >

- Great Traders

- >

- Large investors with thinner wallets

Large investors with thinner wallets

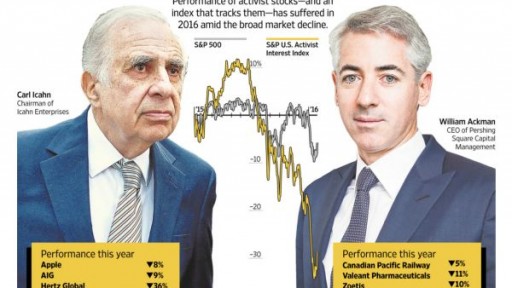

Portfolios activists investment by Carl Icahn and William Akman have declined in recent months, a result of poor investment decisions and global problems in the financial markets.

Publicly traded fund Square Pershing Capital Management LP of Akman reported a negative return of 21% for 2015, the worst year since its creation. The fund holds seats on the boards of companies such as Canadian Pacific Railway Ltd. and Zoetis Inc. January was not better for Pershing, which was hurt by declining shares of Valeant Pharmaceuticals International Inc. Public fund to take into account 11% in just one day.

Meanwhile, Icahn upsurge changes in companies including Hertz Global Holdings Inc., American International Group Inc., and last week, Xerox Corp. experienced a drop by 14%, bringing the cumulative loss to 12 months from 46%. Icahn Enterprises LP, which holds all of its companies hurt by declines in energy shares in its portfolio

With smaller portfolios are not only the two investors. It takes into account S & P U.S. Activist Interest, tracks companies controlled by such investors, is down by 25% over the past 12 months and 12% this year.

"Although nobody is enthusiastic about the news of the worst annual performance to date, it will certainly have a positive impact on management decisions in the future, which is necessary for long-term investment performance," Akman wrote to investors in his annual letter.

The resources of the activists tracked by HFR Inc. Outgoing had net assets of $ 1.5 billion in the fourth quarter after seven consecutive quarters of cash inflows. They still ended 2015 with a record $ 123 billion, said HFR.

But the biggest names in investment by Trian Fund Management LP, Jana Partners LLC and Third Point LLC have survived the crisis and have become stronger in recent years.

"No doubt, I lost money last year, but activism is sure to be ready and to stay for long periods of time, and we've seen that roll before," said Icahn in an interview, pointing out that there made billions of investments. "Just take Forest [Laboratories Inc.], where some people laugh, but who laughs last laughs best, and we did $ 2 billion."

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.