- Home

- >

- FX Daily Forecasts

- >

- Last defensive line for USD Short Sellers

Last defensive line for USD Short Sellers

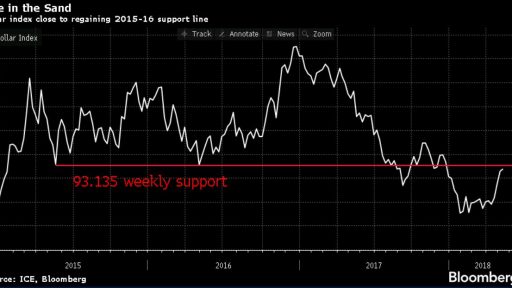

Over the past few weeks, much of the bulls of the dollar have breathed, because of its "revival," and perhaps 99% of retail traders are of the opinion that the trend is already rising and nothing to stop USD. But let's take a look at the weekly chart that everyone skilfully misses.

The dollar reaches levels of resistance formed by the bottoms in 2015 and 2016. If DXY goes over and stays there, then there really will be nothing to stop the dollar, and we can safely say that the trend is Long. To find out in detail what the Dollar Index is moving, we need to see what it is built from. The index is based on the value of several currencies against the dollar, with the highest weight being EUR - 57.6%, followed by JPY by 13.6%, GBP by 11.9%. These three currencies have the highest weight in the index and, according to Bloomberg analysts, it's good to look at them to find out what moods are and can we expect a DXY breakthrough. According to a large number of market participants, EUR/USD holdings above 1.1800 and GBP/USD above 1.3500 would be an adequate reason to expect a fall in the index.

Source: Bloomberg Pro Terminal

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.