- Home

- >

- Great Traders

- >

- Leon Cooperman – what does it take to be a brilliant hedge fund manager.

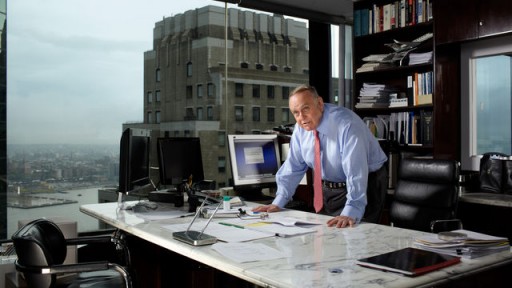

Leon Cooperman - what does it take to be a brilliant hedge fund manager.

Cooperman was born in 1943 in the South Bronx and became a Xerox quality control engineer in 1965. After earning his MBA at Columbia University, he joined Goldman Sachs, where he rose to the head of the bank's asset management business. He departed in 1991 to found Omega.

There are 14 hallmarks that the founder of Omega Advisors, look for, before hiring at his company:

1. The desire and commitment to be the best.

2. Strong work ethic.

3. Thorough and penetrating analysis/in-depth research with a strong analytical foundation.

4. Good communication skills critical. Can easily write a several page summary of his or her investment views.

5. Have an intensity which leads one to be on top of positions and ahead of the crowd.

6. A good nose for making money, e.g. know a good idea when you see one; make sure the position is meaningful for the organization; know when to back away when the developments are not anticipated—effective risk management.

7. Have conviction with respect to investment recommendations and confidence to add to a position if fundamentals are intact but stock is down.

8. Be aware of not only absolutely P&L but also return on capital. Judicious use of capital.

9. Team player — particularly important in tapping into the expertise of an organization.

10. In a typical year, an analyst should be able to produce at least three or four core investment ideas and 10 to 12 trading ideas.

11. Pride of ownership, sense of loyalty to the organization and commitment to clients.

12. Unbiased and willing to admit mistakes, skeptical, creative, curious, bold/edgy, able to take risk.

13. Can identify his or her comparative advantage and capitalize on this.

14. Identify variant perception.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.