- Home

- >

- Great Traders

- >

- Lessons by the great forex trader Bruce Kovner

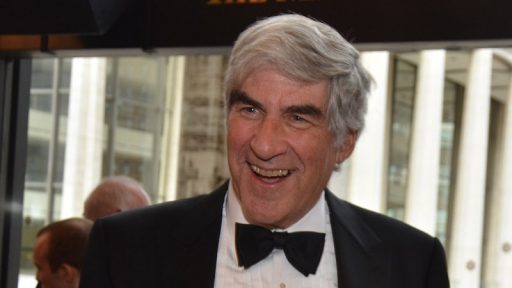

Lessons by the great forex trader Bruce Kovner

Bruce Kovner retired in 2011 from Caxton Associates, the hedge fund he founded and ran for 28 years.

Over that time the fund returned an average of 21 percent a year since its inception. In comparison, the SPX averaged just 11%. Kovner had only one losing year (in 94’).

Here are some wisdoms he shares:

Having the Necessary Vision

Michael taught me one thing that was incredibly important… He taught me that you could make a million dollars. He showed me that if you applied yourself, great things could happen. It is very easy to miss the point that you really can do it. He showed me that if you take a position and use discipline, you can actually make it.”

The Importance of Risk Management

The first rule of trading — there are probably many first rules — is don’t get caught in a situation in which you can lose a great deal of money for reasons you don’t understand.

I would say that risk management is the most important thing to be well understood. Under trade, under trade, under trade is my second piece of advice. Whatever you think your position ought to be, cut it at least in half.

Through bitter experience, I have learned that a mistake in position correlation is the root of some of the most serious problems in trading. If you have eight highly correlated positions, then you are really trading one position that is eight times as large.

Whenever I enter a position, I have a predetermined stop. That is the only way I can sleep. I know where I’m getting out before I get in. The position size on a trade is determined by the stop, and the stop is determined on a technical basis.

A Trader’s Mindset

To this day, when something happens to disturb my emotional equilibrium and my sense of what the world is like, I close out all positions related to that event.

Successful traders are strong, independent, and contrary in the extreme. They are able to take positions others are unwilling to take. They are disciplined enough to take the right size positions. A greedy trader always blows out.

The Importance of Macro

I almost always trade on a market view; I don’t trade simply on technical information. I use technical analysis a great deal and it is terrific, but I can’t hold a position unless I understand why the market should move.

There are well-informed traders who know much more than I do. I simply put things together… The market usually leads because there are people who know more than you do.

Mastering Price Action

The principle characteristic of a bear market is very sharp down movements followed by quick retracements… In a bear market, you have to use sharp counter-trend rallies to enter positions.

There is a great deal of hype attached to technical analysis by some technicians who claim that it predicts the future. Technical analysis tracks the past; it does not predict the future. You have to use your own intelligence to draw conclusions about what the past activity of some traders may say about the future activity of other traders.

Trading and The Heisenberg Principle

The general rule is: the less observed, the better the trade. The more a price pattern is observed by speculators, the more prone you are to have false signals. The more a market is the product of non-speculative activity, the greater the significance of technical breakouts.

Junior Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.