- Home

- >

- Market Rumours

- >

- Low VIX Masks Insurance Markup Options Traders Are Paying

Low VIX Masks Insurance Markup Options Traders Are Paying

Here’s another sign that beneath the surface of placid stock markets, investors aren’t exactly sound asleep.

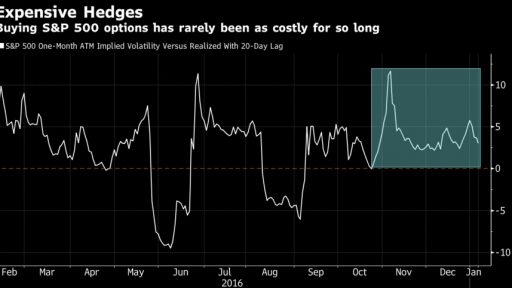

It’s the persistently high premium traders are paying for equity options, visible in the difference between implied and realized volatility in the S&P 500 Index. The gap, definable as the intangible cost of stock insurance over and above what is accounted for by the market’s swings, has now lingered for 51 trading days.

That’s the longest streak in almost a year and one of the longest in the past decade, data compiled by Bloomberg show.

Implied volatility has exceeded realized by 3.9 points on average each day since October, about 12 times the average gap over the past decade.

In the last 10 years, the longest run of S&P 500 implied volatility trading above realized swings lasted 81 days through March 2012. The VIX rallied 43 percent in the following two months as the S&P 500 slumped, reaching a low in June of that year.

In other occasions when volatility bets were above actual price fluctuations for more than 51 days, the VIX fell in four of the six instances. Last year, it jumped ahead the British vote to leave the European Union.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.