- Home

- >

- Fundamental Analysis

- >

- Macro hedge funds – disappearing dinosaurs

Macro hedge funds - disappearing dinosaurs

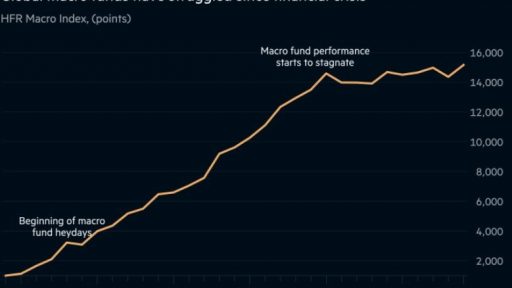

Last week, Louis Bacon decided to quit the game. After 30 years at the top of the industry, Bacon has closed its Moore Capital Management, which is understandable. But it's also symbolic why macro hedge funds like Moore have been doing over the last 10 years.

Many of the traders who have been reaping the benefits of seismic economic trends are beginning to experience difficulties. Last week, another macro hedge fund also closed. Stone Milliner Asset Management, which managed $ 3 billion, founded by Bacon followers. This is just part of a series of closures of this type of fund, such as Passport Capital and Eclectica>

Overall, the hedge fund industry is experiencing headwinds, with poor performance on all fronts. Investor money continues to flow from them, and closures begin to outpace the openings for the fifth consecutive year.

Macro funds are still managing $ 245 billion, despite cash outflows of $ 23 billion this year. Several of the biggest, such as Brevan Howard, Caxton Associates and Tudor Investment, have been experiencing something like a renaissance lately.

One of the main elements that keeps hedge funds active and missing at the moment is volatility. The truth is that market volatility has been in a downtrend for years. Apart from the occasional outbursts of turbulence, stocks, bonds, commodities and currencies are becoming quieter. It is widely understood that market calm was achieved with low interest rates and quantitative easing by central banks, which played a huge role. But macroeconomic calm must also be taken into account.

This may sound strange to you, given what it was during the 2008 financial crisis. It still draws attention to the chaos in Europe and the occasional fleeting crises in EM markets. The world has the feeling that the situation is not stable. However, the economic data is impressive, presenting us with a picture of stability.

Inflation is an example we can bring to a calm macro environment. It still remains highly resilient to both booms and recessions over the last 20 years.

This is a difficult environment for hedge funds that specialize in accumulating profits from economic trends and anomalies. Of course, this era of tranquility would break down at any moment, which would immediately have a positive impact on the Funds. However, many of their tactics, such as using global cash flows to analyze market changes, are already being systematically exploited by quant funds. The market has changed with shorter trends, which make computers work better and more efficiently.

Talents are hard to come by. More macro managers have studied the craft of trading offices at investment banks. However, they suffered damage during the financial crisis and were wiped out. Being a good market maker is already fundamentally difficult as a skill. This raises the question of the next generation of macro hedge fund managers.

There will always be opportunities in specific niches, such as the artfully crafted trades around political events that machines will always try to capture from earlier. Macro hedge funds are unlikely to disappear altogether. However, they will certainly look a lot different than they are now. They will transform from the Titans to the industry ... into something else.

Source: The Financial Times

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.