- Home

- >

- Daily Accents

- >

- Maestro caught between economic risks and QE exit

Maestro caught between economic risks and QE exit

The European Central Bank President Mario Draghi has to tread a fine line once again as he gives his latest update on euro area monetary policy on Thursday.

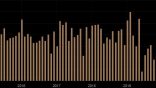

While steering the bank out of its QE (quantitative easing) program and stressing interest rates and reinvestments going forward, Draghi is faced with an economy that may be slowing and a dreary inflation outlook.

"We expect the ECB to announce at its meeting next Thursday an end to net-purchases under the APP programme," said Natixis' Dirk Schumacher in a note. "While there has been a clear weakening in the economic environment, the ECB will argue that the reinvestment of the stock of bond holdings will ensure a continuing accommodative policy stance justifying an end of the program," he added.

On Thursday, the ECB also will publish its newest staff projections for economic growth and inflation for the next three years. While it is expected that the central bank will lower its outlook for growth for the next two years, the numbers are also expected to remain just punchy enough to underline the case to exit their purchase program.

Another big topic for Thursday will be the design of the ECB's reinvestments.

"The ECB will likely maintain its guidance that it will fully reinvest the proceeds and thus keep its bond holdings constant 'for an extended period of time' and 'for as long as necessary' to put inflation on track towards its target," said Florian Hense, Economist with Berenberg.

"The ECB may also state explicitly that full reinvestment will continue until well after the first rate. We expect full reinvestments to run until at least late 2020," he added in a note.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.