- Home

- >

- FX Daily Forecasts

- >

- Major supports and resistances on the common currency crosses

Major supports and resistances on the common currency crosses

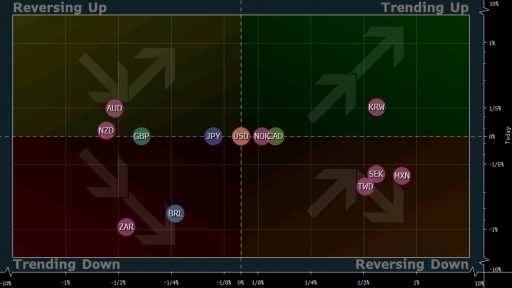

* EUR/USD -- Retains bearish tone below 55-DMA at 1.0675

* 3rd resistance: 1.0799, March 28 low

* 2nd resistance: 1.0740, March 29 low

* 1st resistance: 1.0714, 21-DMA

* 1st support: 1.0652, 61.8% Fibonacci of March rally

* 2nd support: 1.0643, April 3 low

* 3rd support: 1.0600-03, March 14-15 lows

* GBP/USD -- 55-DMA at 1.2432 remains pivotal for short-term

direction

* 3rd resistance: 1.2615, March 27 high

* 2nd resistance: 1.2567, April 3 high

* 1st resistance: 1.2496, April 4 high

* 1st support: 1.2403, March 30 low

* 2nd support: 1.2384, 21-DMA

* 3rd support: 1.2324, March 17 low

* EUR/GBP -- Re-tests 55-DMA resistance

* 3rd resistance: 0.8618, March 28 low

* 2nd resistance: 0.8605, March 23 low

* 1st resistance: 0.8588, 55-DMA

* 1st support: 0.8537, April 4 low

* 2nd support: 0.8482, 233-DMA

* 3rd support: 0.8467, pivot s3

* USD/JPY -- Bearish momentum holds, threatens March lows

* 3rd resistance: 112.35, 21-DMA

* 2nd resistance: 111.25, March 31 low

* 1st resistance: 111.15, Ichimoku conversion line

* 1st support: 110.27, April 4 low

* 2nd support: 110.11, March 27 low

* 3rd support: 110.00 psychological level

* EUR/JPY -- 233-DMA at 118.12 holds on a closing basis

* 3rd resistance: 119.02, March 29 low

* 2nd resistance: 118.63, March 31 low

* 1st resistance: 118.46, Asia high

* 1st support: 117.39, Nov. 22 low

* 2nd support: 116.68, 61.8% Fibo retracement of Sep. 21-

Dec. 15 rally

* 3rd support: 116.26, Nov. 17 low

* USD/CHF -- Rally momentum wanes at 21-, 55-DMAs at 1.0001-16

* 3rd resistance: 1.0108, March 15 high

* 2nd resistance: 1.0061, March 13 low

* 1st resistance: 1.0035-39, 61.8% Fibonacci of March 7-27

fall, April 3 high

* 1st support: 1.0001, April 3 low, 21-DMA

* 2nd support: 0.9976, March 29 high

* 3rd support: 0.9949, March 30 low

* AUD/USD -- Bears comfortable as cross closes below 21- and

55-DMAs

* 3rd resistance: 0.7712, 76.4% Fibonacci of March 21-28

fall

* 2nd resistance: 0.7623-27, 21-, 55-DMAs

* 1st resistance: 0.7615, April 4 high

* Spot: 0.7574

* 1st support: 0.7555, March 15 low

* 2nd support: 0.7522, 233-DMA

* 3rd support: 0.7491, March 9 low

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.