- Home

- >

- Trading University

- >

- Making the best use out of moving averages

Making the best use out of moving averages

A moving average is a simple tool that traders use for different purposes. The main advantage is that it makes trading smoother and if used correctly, can lead to favorable trading results.

A simple moving average is calculated by adding the price of a currency pair (Open/High/Low/Close) for a set period "X" and then dividing the sum by this number "X". For example, to identify a 5-day moving average you would add up the closing prices of the last 5 days and then divide the result by 5. There are several types of moving averages, but traders mostly use the Simple and Exponential Moving Average.

The difference between these two types of moving averages is that the Simple Moving Average will give equal weight for all the periods while the Exponential Moving Average will give more weight to the most recent periods. Some traders may believe that the difference does not affect the outcome. The Simple Moving Average is smoother and will respond more slowly to the latest price action, which is good in the case of a false breakout as this prevents traders from jumping into a losing trade. On the contrary, the Exponential Moving Average responds faster to the latest price action and allows the trader to join a new trend faster but remains subjected to fake outs (when a trader believes a price action will take place but it never get fulfilled).

Now, after explaining the differences between the two most used moving averages, we should understand how we can benefit from these moving averages.

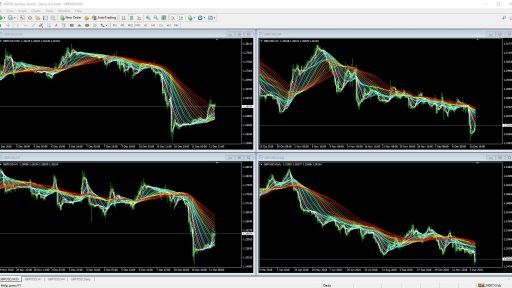

Traders can use moving averages to detect the trend of a certain financial product. We plot one moving average on the chart with a specific period and trade the crosses between the price and the moving average. In other words, if the price moves above the moving average, we can enter a long (buy) position, and if the price moves below the moving average, we can enter a short (sell) position.

Traders can add two moving averages: one with a short period (fast), one with a long period (slow). The moving average that has the shorter period will substitute the price which means when the fast moving average crosses above the slow moving average, the trader can initiate a long (buy) position, and if the fast moving average crosses below the slow moving average, the trader can initiate a short (sell) position.

Another strategy that can be applied using moving averages can be plotting a fast moving average for execution when crossing above or below the price along with a slow moving average to confirm direction or bias.

Moving averages are also used as dynamic support and resistance levels. They are called dynamic because they change along with the recent price action. This means that traders expect a falling price to bounce when touching a moving average. Therefore, the moving average will act as support (heavy buying overcomes selling power) and vice versa. A rising price is expected to falter when touching a moving average. Therefore, the moving average will serve as a resistance (heavy selling overcomes buying power).

Many traders ask about the best moving average periods which could provide the best trading outcome. There are no perfect periods. Usually, traders use the 50-100-200 periods. Traders should always set the periods based on their trading strategies and style. For example, a trader uses 5 and 21 periods on the daily charts as he believes that if the price action of the last 5 days differed from the price action of the last 21 days than the market is going to change the direction.

Always use periods that match your trading style and strategy.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.