- Home

- >

- Great Traders

- >

- Marc Faber: Trump will be good for Asia

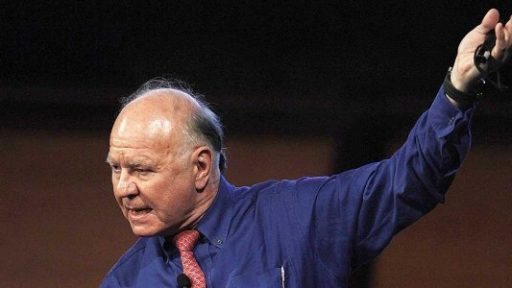

Marc Faber: Trump will be good for Asia

U.S. President Donald Trump's protectionist rhetoric will be good for Asia, pushing the region's stock markets to outperform, said Marc Faber, the publisher of the Gloom, Boom & Doom report.

"It is a Chinese-centric Asia nowadays," he said. "The exports of Taiwan, South Korea, to China are much more important than to the U.S. All the Asian countries for them, exports to China are the key, tourists from China are the key."

During his campaign, Trump vowed to label China a currency manipulator for the purposes of a competitive trade advantage, even though the country has actually been propping up its currency.

In other signs of a protectionist bent, last month, Trump formally pulled the U.S. out of the Trans-Pacific Partnership (TPP), which would have created a 12-country Pacific Rim free-trade bloc. The TPP, which was negotiated during President Barack Obama's term in office, hadn't yet been voted on or ratified by Congress.

Trump also signaled he planned to renegotiate the North American Free Trade Agreement (NAFTA), enacted in 1994, which eliminated most tariffs between Mexico, the U.S. and Canada.

"Everybody in Asia and around the world, including Mexico and the Europeans will say, 'the U.S. is no longer a reliable trading partner and no longer a reliable ally. We have to look after ourselves,'" he said. "So the Chinese are pushing essentially domestic-led growth."

At the same time, Faber expected that U.S. markets might not perform as well as emerging markets, despite the "hoopla" over Wall Street's recent rally.

He noted that the U.S. economic expansion and the bull market were now around 8 years old and getting "mature."

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.