- Home

- >

- Fundamental Analysis

- >

- Marc Faber: Trump’s policies mean I’m ‘obviously not optimistic about the US dollar’

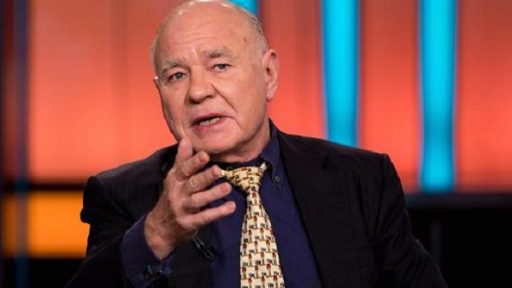

Marc Faber: Trump's policies mean I'm 'obviously not optimistic about the US dollar'

The U.S. dollar could "easily rebound" by 4 to 5 percent from current levels, but President Donald Trump and his administration stand in the way of the currency's long-term strength, Marc Faber said Thursday.

The greenback has had a tough year, with the dollar index tumbling nearly 10 percent since the start of 2017. At the same time, gains among currencies such as euro and peso also added to the dollar's pain.

"I think the dollar could easily rebound by 4 to 5 percent, or maybe even more. Longer term, I'm obviously not optimistic about the U.S. dollar. You just have to look at the U.S. administration and their economic policies that will not be very conducive for dollar strength in the long run," Faber, the editor and publisher of The Gloom, Boom & Doom Report, said on CNBC's "Squawk Box."

"They're actually shooting themselves in their own feet, so long term I'm obviously negative about the U.S. dollar," he added.

Despite his longer-term bearishness, the widely-followed analyst said he is looking to shift some euros in his portfolio into dollar.

"The question is which currency is much better than the U.S. dollar? They're all not so desirable, that's why some people invest heavily in the so called cryptocurrencies," he said, referring to the money flowing into assets such as Bitcoin.

Faber has not dabbled in cryptocurrencies himself but acknowledged that they offer opportunities to make money. The rapid increase in supply of cryptocurrencies has made it difficult for investors to put a value on the digital money.

He also said that emerging-market shares and gold could do well. Faber is looking to buy stocks in China, Singapore and Thailand.

"I don't want to increase my bond exposure. Every year, some bonds are maturing, and as a result I'm reducing somewhat the bond exposure," he said. "I think the environment going forward, as had been the case in the first six months of the year, is that active managers can perform well by being overweight" in emerging markets.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.