- Home

- >

- Daily Accents

- >

- Market overview at the end of the European session

Market overview at the end of the European session

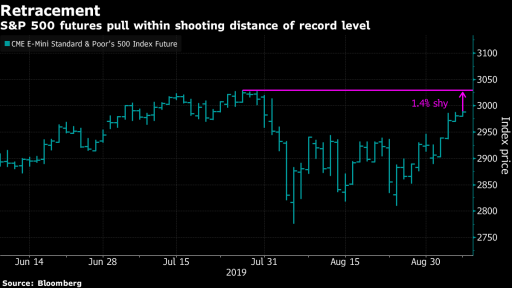

At the end of the European session, US stocks continue the rally led by the financial, energy and consumer sectors. Yields on US and European bonds are also rising today.

AT&T is today one of the most prominent stocks since the Elliott Management Fund increased its investor interest in the communications company. Earlier today, Steven Mnuchin announced that the United States and China had many productive talks ahead of their official meeting in October.

The sentiment surrounding the trade war is driving the markets, and at this stage we have some optimism. Following last week's comments on the upcoming talks and the significant de-escalation of the situation, markets are already calculating the news.

The dollar index continues to fall in price as Jerome Powell further confirms the Fed's intentions to cut interest rates. And over the last few days, the Chinese authorities have taken a number of measures to improve fiscal conditions.

The Stoxx Europe 600 continues its sharp movements in both directions after bonds fell in the Eurozone. Investors are showing less and less belief that the ECB will announce a bold and accurate decision to ease policy on Thursday. German exports, however, performed better than expected.

The central banks are again in the spotlight in anticipation of another wave of protectionism in the shadow of a slowing global economy. No other talks or meetings between China and the US are expected until October. However, traders remain under pressure after weaker export data from China in August and mixed labor market data from the US last month.

Oil continues to thrive after Saudi Arabia sacks its old energy minister, and the new minister signals that OPEC and OPEC + will continue to reduce production. The group is preparing for a meeting this month in Abu Dhabi.

The UK Parliament will not work until next Monday, until the blockbuster No - deal Brexit bill officially becomes law within days. For Thursday, investors are gearing up to see a rate cut and QE review. Economic forecasts for growth and inflation will also be key. Mario Draghi will hold a press conference.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.