- Home

- >

- Daily Accents

- >

- Market participants’ comments on Brexit and the Pound

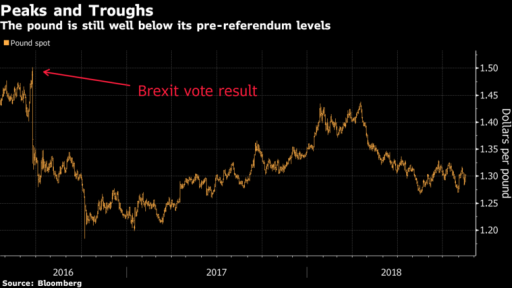

Market participants' comments on Brexit and the Pound

Up, down or anywhere?

Here are some colorful comments about the Brexit drama and where market participants see the price of pounds in the coming months:

Deutsche Bank (Alan Ruskin, global co-head of FX research)

- The GBP ended in a positive territory close to $ 1.30

- The market sends a message that concerns remain about whether the transaction will be ratified by Parliament

- If we do not have new negative news, the level of $ .130 will remain stable

BMO (Greg Anderson, global head of FX strategy)

- We will most likely see a high volatility in the pounds by the end of the year awaiting completion of the negotiations

- A lot of false signals from official representatives to the markets that give up empty hopes

In the next three months, we see pounds around $ 1.26. Any move over $ 1.30 is a sell for us

Danske Bank (Mikael Olai Milhoj, senior analyst)

- Hard pounds will recover with all this uncertainty

- It all depends on the votes in Parliament

- The pounds will remain volatile until we find out whether the deal will pass or not

- We see EUR / GBP around 0.84 if the vote passes in favor of the deal

Allianz Global Investors (Kacper Brzezniak, money manager)

- We keep long positions of the Pound after Cabinet support to May

- There is a lot of noise on the market, but there are not enough arguments to support the fear that there will be no deal

- If we have a deal, the GBP will go up

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.