- Home

- >

- Daily Accents

- >

- Market preview after the London fix

Market preview after the London fix

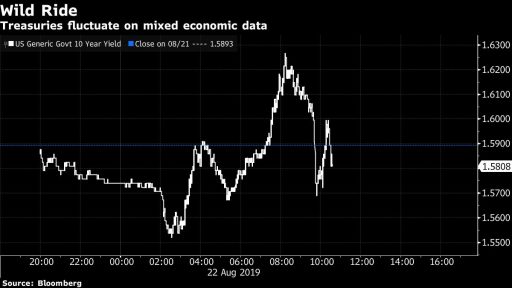

US markets have wiped off positive growth from earlier, already in red territory. The market fluctuation today is due to the fact that we have seen mixed economic data. Yesterday's FOMC report also failed to provide clearer and more meaningful explanations and traces of monetary policy. Now the market is focusing on Jackson Hole on Friday.

US indices started the day green, but Jobless claims data showed once again how strong the labor market is. The indices lost steam after production activity data contracted. Yields on 10-year bonds remain high after Kansas City FED Chair Esther's comments that no further interest rate cuts are needed. Her Philadelphia counterpart, Patrick Harker, confirmed his "hold" status for the relief.

In the euro area, sovereign securities continue to decline after the ECB voiced concerns that investors are losing faith in the financial institution's ability to revive inflation. The British pound remains strong today, following comments by the French president and German chancellor, sharing his optimism that a Brexit deal could be reached.

Financial markets remain volatile around the still current fears of a global recession and the eventual flare-up of trade conflict. The FOMC for July revealed yesterday that Fed officials have seen interest rates cut as "insurance" against too low inflation and the risk of further declines in business investment. Analysts expect Powell to give clear signs that the central bank is ready to cut interest rates further. That is expected to happen on Friday at Jackson Hole.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.