- Home

- >

- Daily Accents

- >

- Market sentiment before the opening

Market sentiment before the opening

First facts from the beginning of the weekend until now:

- The National Party in New Zealand won the country's election

- Provocation from Iran - The country is testing a new ballistic missile.

- The tension between the United States and North Korea does not slow down

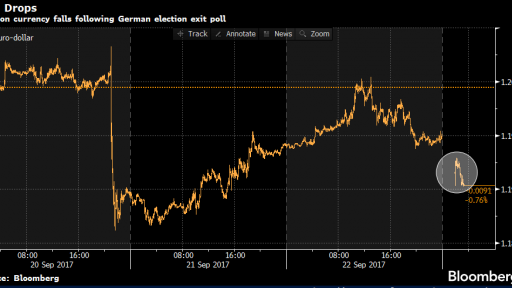

- Angela Merkel won the elections in Germany, we are expecting a new coalition in the coming days.

After months of provocation in terms of nuclear weapons came from North Korea at the beginning of the weekend, and Iran officially declared that it had successfully tested its new ballistic missile with a range of 2000 kilometers, and it could be equipped with different types of warheads . A few days ago, President Hassan Ruhani announced the expansion of his country's military capabilities and missile program. "When it comes to defending our country, we will not ask anyone for permission," he said.

On behalf of North Korea, leader Kim Jong Un said the next nuclear weapons test would be in the Pacific Ocean. There were many speeches and attacks, both on the part of Donald Trump and the North Korean Foreign Minister, and Jon-ho.

Despite growing geopolitical tensions, the JPY will start a downward session, with the USD/JPY expected to open at a peak of 20 pips at 112,245.

Merkel's victory will not support the EUR/USD in the first minutes of the trade, with the pair expected to open nearly 40 pips at a price of 1.1905.

After the New Zealand elections, the NZD will start lower, with NZD/USD expected to open at about 0.7306 or 20 pips lower than Friday. AUD/USD will begin trading at 0.7938 levels or 25 pips lower.

Gold is expected to start trading without change.

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.