- Home

- >

- Stocks Daily Forecasts

- >

- Markets appear to have built their immunity against high bond yields

Markets appear to have built their immunity against high bond yields

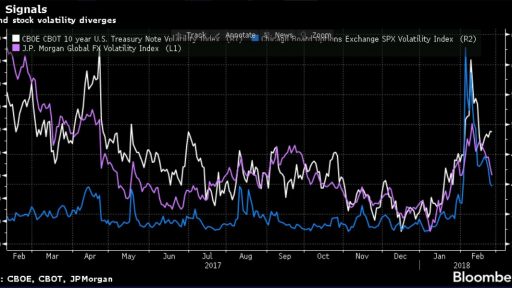

Looking at the strong stock growth at the beginning of the week, it's a good idea to pay attention to the VIX Fear Index to make sure that it's a steady growth rather than an unsustainable tick in the upward direction. The chart shows the three major volatility indexes, two of which point downwards and one remains worryingly high. The JP Morgan FX Volatility Index, along with VIX, is down, and given market growth, they are already in the mid-range area, indicating no panic or over optimism in the FX and Stock Markets.

By contrast, the CBOE CBOT 10 Year Treasury Note Volatility Index remains at high levels, showing the strong interest of traders in 10-year US bonds. A look at the Bloomberg Treasury Monitor shows that today for a day the yield on 10-year US bonds marks an increase.

Like North Korea's missile testing, markets have built up their immunity against high inflation, high yields on bonds, and a nearly 100 percent probability of raising interest rates four times in 2018. The technology sector led the index growth, with NASDAQ100 almost able to cover the correction in early February. With good economic data from the US, Asia and Europe, we expect the indices to be able to register a test on the peaks before the adjustment. A break above the previous All Time high will lead to increased positivism and a high probability that bulls will continue the long-term bullish trend.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.