- Home

- >

- Daily Accents

- >

- Markets are entering the ‘frothy territory’ reached before the last 2 financial crises

Markets are entering the 'frothy territory' reached before the last 2 financial crises

Stocks look expensive by multiple measures, and they have for a while now. But that hasn't stopped major indices from achieving new highs as market fundamentals have looked more than capable of withstanding higher prices.

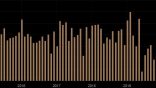

That all could change as the stock market swells to a size rarely seen outside of 2000 and 2008, just before the two most recent stock market crashes, says Deutsche Bank.

Rather than assessing the stock market using more traditional methods such as price-to-earnings ratio, Deutsche is instead looking at equity market cap as a percentage of gross domestic product (GDP). And it attributes the recent rise in historical highs to a shift in monetary policy.

While global markets benefited from a "long period of post-global financial crisis accommodation," that's changing as central banks like the Federal Reserve move to tighten.

This central bank action "raises the returns on safe assets and lowers the valuation of risk assets," Mikihiro Matsuoka, the chief economist at Deutsche, wrote in a client note.

But it may not happen right away. Matsuoka admits that any correction in stock prices could be put on hold if the nominal GDP growth rate remains above the long-term bond yield — something entirely possible due to "massive" monetary accommodation.

Source: Bloomberg Pro Terminal

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.