- Home

- >

- Daily Accents

- >

- Markets are signaling for a recession in 2019

Markets are signaling for a recession in 2019

Investors have already begun to adjust their portfolios in anticipation of a recession by the end of 2020, but economic indicators are starting to send another message: We have to prepare for a more recent recession in the early 2019s. The chances of a recession in 2020 , currently 16%, according to the Federal Reserve Bank of New York. The highest rate since November 2008

The pace with which markets are reacting is the signal that suggests that the recession may occur sooner than expected. Especially the fall in oil prices is indicative. Despite the agreement between OPEC and Russia to reduce the daily yield by 1.2 million barrels per day, starting this month, WTI's price has fallen by more than 40% since October. This was due to expectations that demand for oil would fall even further than the contraction in production that OPEC and its allies are planning to implement.

The International Monetary Fund cut its growth forecast in 2019 after the US and Chinese economies began to show signs of slowdown. China's production data was 49.4 for December, the weakest in 2016, and is below the 50 level, indicating a contraction in the economy. One of the largest oil importers, Japan, reported a shrinking gross domestic product in the third quarter, and the economic weakness is set to continue to manifest in 2019.

Recent US housing data, the backbone of the economy, reflected a weakness in new construction, the number of completed construction and mortgage credit applications. The rise in property prices since the financial crisis, coupled with a relatively sluggish rise in wages, has reduced purchasing power. The impact of this effect has caused many buyers to slow down their purchases, which affected the 30-year fixed interest rate, which fell to 4.54% in December from 4.82 in November.

Recession bets were announced by the Fed on Dec. 19 after they raised their benchmark interest rate for the fourth time in 2018. Markets had already appreciated expectations of interest rates but what Powell said at the press conference came as a shock to market players. He said he expects two more interest rises in 2019. Powell only worsened the negative effects on the market after he added that he would begin to reduce his balance sheet by $ 50 billion each month and that they would pass on to the "autopilot".

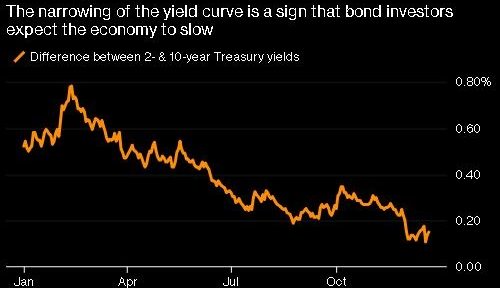

The bond market also signaled the likelihood of a recession as yield curves turned back last month. The curve of five-year bonds went below that of two and three-year-olds.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.