- Home

- >

- Fundamental Analysis

- >

- Markets Wrap

Markets Wrap

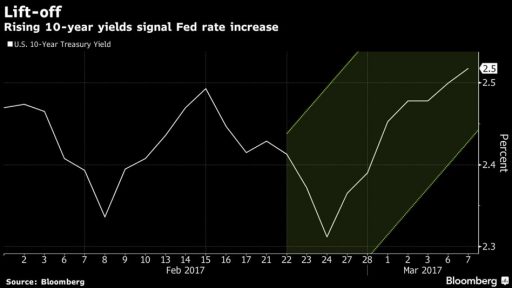

Treasuries headed for the longest losing streak in five years before a U.S. debt auction on Wednesday and as the market prepares for the Federal Reserve to raise interest rates as early as next week. The dollar rose, while sterling extended its decline ahead of the U.K. budget.

The yield on 10-year U.S. notes climbed for an eighth session and most government debt in Europe followed suit. Bank and commodity producer shares responded positively, putting the Stoxx Europe 600 Index on course for its first gain in five days. The British pound slid for the eighth day out of nine before the chancellor of the exchequer delivers his spring budget.

What’s ahead for the markets:

Mario Draghi probably won’t flinch at Thursday’s ECB meeting even after headline inflation reached its 2 percent target in February. He’s expected to keep QE going until the end of the year with underlying price pressures muted.

U.S. jobs data for February are due Friday. Employers probably added around 190,000 workers to payrolls, in line with the average over the past six months and a sign of steady job growth, economists forecast.

Philip Hammond’s U.K. budget arrives Wednesday. The chancellor pledged on Sunday to set aside money to cushion the economy from Brexit.

Here are the main moves in markets:

Asia:Most Asian stocks fell amid lower trading volume. The Topix retreated even as data showed Japan’s economy expanded more than initially reported in the fourth quarter. Chinese shares traded in Hong Kong climbed as a report showed imports surged on seasonal factors.

Stocks:The Stoxx Europe 600 added 0.2 percent as of 10:25 a.m. in London, after declining a fourth straight session on Tuesday.

S&P 500 Index futures pared earlier declines to trade little changed. The benchmark index lost 0.3 percent on Tuesday, completing the first back-to-back declines since January. Health-care shares declined after Republicans released details of a replacement for Obamacare and the president tweeted about lowering drug costs for Americans.

Currencies:The Bloomberg Dollar Spot Index rose 0.2 percent, heading for a third day of gains.

The British pound slipped 0.3 percent to $1.2163, falling for a third day, and the euro fell 0.1 percent to $1.0557.

Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.