- Home

- >

- Great Traders

- >

- Michael Burry from the Big Short: “There is a big bubble in passive investing through ETFs “

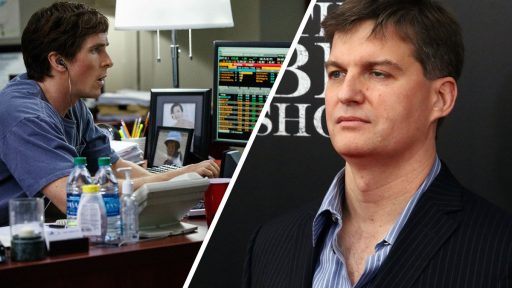

Michael Burry from the Big Short: "There is a big bubble in passive investing through ETFs "

Michael Burry, the doctor-turned-investor profiled in Michael Lewis’s book “The Big Short” for his call on the trouble lurking in mortgage-backed securities before the 2008 financial crisis, has a new big idea:

The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally.’

Many market observers have for years expressed concern about the rush of money into passively managed funds, though few have gone so far as to call it a “bubble.” Academic research published in June shows that three index-fund managers together manage more than $1.8 trillion, and that they could control as much as one-third of all voting shares of S&P 500 companies in the coming years.

Critics worry that such concentration of money in passive investments could amplify any market selloff, but ETF managers point to the big declines in December as proof that ETFs can withstand market shocks.

Burry’s firm, Scion Asset Management, has disclosed big stakes in four small-cap companies, including GameStop Corp. GME, +4.86% and Tailored Brands Inc. TLRD, +7.63% . Burry has asked the managements of both companies to buy back shares, and told Bloomberg that he is taking an activist approach because he believes there needs to be a “critical mass of smaller value-seeking active managers like me.”

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.