- Home

- >

- Daily Accents

- >

- Michael Burry trapped in his own portfolio

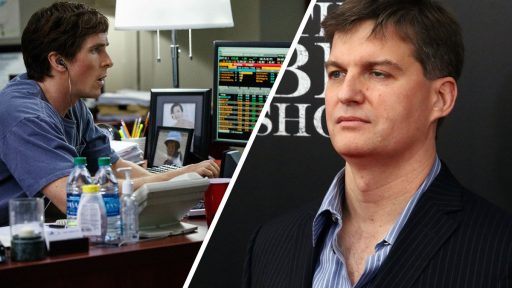

Michael Burry trapped in his own portfolio

Michael Burry is a renowned investor and founder of Scion Asset Management. SAM had more than $ 100 million in management in 2016 and the fund began completing 13F applications to the SEC. Unfortunately, however, it looks like the funds under their control have fallen below $ 100 million and the fund stopped filling them in 2017. Until recently, however, the fund was again beginning to file 13F forms with the SEC. In its latest form, Burry unveils a $ 93 million equity portfolio.

Let me also look at exactly what Michael Burry has been doing lately. His biggest positions are in troubled companies such as Western Digital, Cleaveland Cliffs, Cardinal Health and Tailored Brands. He has also invested in several extremely popular companies such as Alphabet, Alibaba Group and Disney.

Late last week, Michael Burry filled out a 13D document with the SEC, confirming his activist plans for Tailored Brands. Burry spent more than $ 20 million on 2.6 million TLRD shares. This means that its average purchase price was $ 7.75 and TLRD shares closed at $ 5.42 last Friday. The fund also owns 2 750 00 shares of Gamestop, or about 3% of the company, buying them at an average price of $ 4. The company's shares are trading between $ 3.66 and $ 3.90.

In his recent letters to investors, he assures that these companies will get out of the trap and that their appreciation will come in time.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.