- Home

- >

- Stocks Daily Forecasts

- >

- Microsoft has reached $ 1 trillion in market capitalization

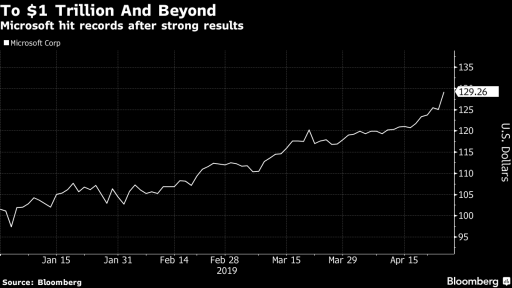

Microsoft has reached $ 1 trillion in market capitalization

Microsoft shares jumped to record levels after the company announced its first-quarter results, with reports stronger than expected. So the company reached $ 1 trillion market capitalization.

As a whole, analysts' expectations were positive, with more than one reasoning behind the rapid and successful expansion of Microsoft's Azure cloud business. Reports show that there is even more potential for this service. After the results, the shares jumped 5.1% after the opening of the US session.

Here's what the reporting banks said:

Goldman Sachs: "As with previous reports, the results are better than expected, with Azure surpassing our expectations." The bank has raised its share price target from $ 131 to $ 144.

UBS: "The good performance of Azure is a strong indicator that businesses are increasingly emigrating to" Clouds "by choosing Microsoft as their first partner." UBS has raised its price target of $ 125 to $ 150.

Citi: "The report shows that companies, despite not investing so much in IT development, with the right product, managed to achieve growth similar to that in 2018" Citi pricing has been raised from $ 110 to $ 130.

Deutsche Bank: "Despite the expectations, Microsoft's results are impressive." The initial prospects for 2020 were "nebulous," but after the reports, we have no doubt that the company will continue to perform brilliantly. Their pricing target was raised from $ 130 to $ 145, and the bank also confirmed its "buy" rating.

Morgan Stanley: "These results bring the company to the first trillion and perhaps beyond." Microsoft remains one of the best names in the IT sphere, particularly Cloud development and infrastructure. " The bank raised its pricing target from $ 140 to $ 145.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.