- Home

- >

- Our trader/investor philosophy

- >

- How To Prevent Ourselves From Over Trading

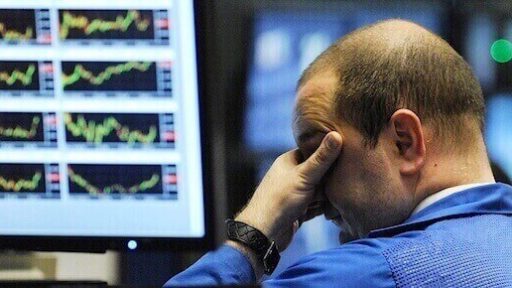

How To Prevent Ourselves From Over Trading

Misconceptions and flaws in thinking are the main reasons for over trading says Rob Colville, a longtime trader and analyst at Wall Street. Toy offers some simple ways to limit over trading.

There are some big misconceptions that cause over trading

And new or inexperienced traders often slaves of thinking that marketing is everything and need constant movement, tracking multiple graphs and indicators at once, working all day, every day plan, implement and manage transactions. And perhaps this is a typical day in the life of some traders.

In fact, this misconception that traders must always be marketing is one of the reasons for over trading, so you have to refute as that other great delusions.

"We can not make money if we are out of the market" while fulfilling deals, traders tend to feel a sense of lose.S Over time, these potential losses are not realized will improve outcome, so from that point with you You can certainly make money by staying out of the market.

"Each session brings endless possibilities," but a very important is that there are no real set-ups that suit your specific strategy to be presented so that there will be no capital to be risked. It's just better when that happens, so no need to force transactions or start over trading just to fill the void. At such times, to resist the temptation to meddle in other markets, trade sub-par set-ups, and switch to unproven strategies, recognizing that trade is not acceptable and expected results, and in the same way and victory loss are.

"The best traders in the world are always on the markets" -Very quickly it can be assumed that the pros are constantly receiving transactions, but if you actually ask them, you will find that professional traders are the most strange because they know when and how to best deal. Why? Well, that's because most pros are professionals who aim to fill their own unique niche markets ... no more, no less. For this, I know traders who have the freedom to trade miss the first hour of the day. We even recently profiled I met a trader who never traded on Wednesday and are only a few examples of respected professional rules gladly spend more time on the sidelines than on the markets.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.