- Home

- >

- Cryptocurrencies / Algotrading

- >

- Mom and Pop outsmart Wall Street professionals

Mom and Pop outsmart Wall Street professionals

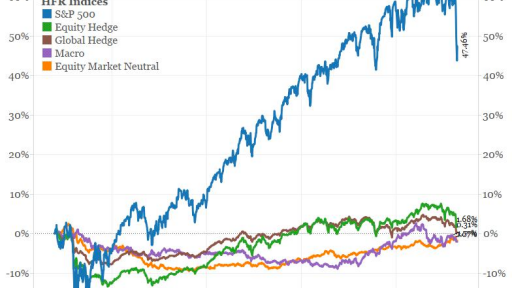

Here are some roles: Mom and Pop were happy to travel through the volatility of the market last month, more or less the trip was tense. Meanwhile, the professionals were driven to a point close to panic.

What was all the fuss? Perhaps slowdown in China would lead to a global recession. Perhaps the Fed will raise rates and kill the bull market. Oil prices may fall too low, destroying emerging markets. Or the US economy is about to turn belly up.

Whatever it was fear, someone was there to give voice. The downside of the era Twitter is that everyone has a megaphone and any lack of insight and knowledge not prevent this radiation. These were professionals who lost it.

Behind the hedge funds, algorithmic traders seemed were also torn. It is a natural human response taken of Daniel Kahneman's book "Thinking, Fast and Slow," to respond to the second is the first emotional and logical. However, no one can think faster than a machine and HFT failed to include very fast, and it seemed as emotionally driven trade. As we saw this week, this behavior is fully punishable. Josh Brown summed up in one post, "Computers are the new" dumb money "":

You want the box with the results of the battle on the stock exchange Press last week?

No problem: People-1 machines-0

Sometimes transactions are instant, too fast; Sometimes the best thing you can do is not to do nothing. As Gillian Tett of the Financial Times noted, computers exercise control the volume of trading on the stock exchanges:

Orders are executed with lightning speed and larger volumes. But there is another, often overlooked intervention: these machines are programmed to connect to multiple market segments together into trading strategies. So when computer programs can not buy or sell assets in a segment of the market, they will rush to another, hunting for liquidity.

It's all part of a long series of adaptations of Main Street investors to the newest thing and a counter of (alleged) professionals. In response to this, Mom and Pop know gastropods well: they trade less and invest more. They set more noise sent CNBC ratings at record lows. They avoid t. Pomegranate. Stock pickers and include indices and exchange traded funds. They have figured out that the way you can defeat HFT is a low incidence of investment.

Speaking about the new "dumb money" being sunk by the ETFs. Although US stocks as a whole have never fallen more than 6%, there were widely held ETFs, they have temporarily lost a third of its value.

Ben Carisolo describes this as ETF flash crash

In the first minutes of the opening of the stock market on Monday morning there was something weird. After a huge downside in futures trading overnight, the NASDAQ down almost 9%, while the S & P 500 fell about 6 percent immediately after the bell to open the procedure. Monitoring in real time was a funny sight. Less than 15 minutes later, the vast majority of these losses are recovered. Many individual stocks saw further big moves.

Mom and Pop outwitting high frequency traders; hedge funds would Main Street. It's enough to give long-term investors some hope for the future of finance.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.