- Home

- >

- FX Daily Forecasts

- >

- More upside in AUD is coming

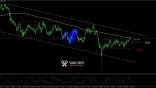

More upside in AUD is coming

Australia's resurgent exports could push its currency to 80 U.S. cents and even beyond, Deutsche Bank's Chief Economist Adam Boyton reckons.

The nation's shrinking current-account deficit, which has been driven by a surge in commodity prices, means Australia now only needs about a third of the capital it required a year ago to cover the shortfall, says Boyton. The relative appeal of the nation's bonds -- seen in the difference between Australian and U.S. yields -- suggests that capital will keep coming in. Any inflows surplus to the current-account's smaller requirements will put upward pressure on the currency, which has surged 6.5 percent this year.

``In essence we are comparing export-driven movements in the current account deficit to interest rate differentials; arguing that an export-driven narrower current account, for any given interest rate differential, should see a higher Australian dollar,'' Boyton said in a research note Monday. ``Our construction is not only highly correlated with the Australian dollar, but in fact tends to lead movements in the currency.''

Australia's current account narrowed to 1.5 percent of gross domestic product last quarter from 5.5 percent a year earlier, Boyton estimates, and he expects further improvement in the first three months of this year. A narrowing of that scale normally comes when the domestic economy is moribund and demand for imports collapses; but this time it's the result of surging prices for iron ore and coal.

Deutsche estimates Australian exports as a share of GDP were 21.2 percent in the fourth quarter of last year, and will climb to about 22 percent in the first three months of this year. The jump ``combined with the prevailing interest-rate differential suggests risk of further upside in the Australian dollar toward and indeed above 80 U.S. cents,'' said Boyton.

RBA Governor Philip Lowe earlier this month signaled a level of comfort with the currency, which has bought between 76 and 77 cents during February. He said the central bank bases its judgement on whether a configuration of interest rates and currency delivers reasonable growth. Given the RBA is forecasting a 3 percent expansion, it's ``hard to say'' the exchange rate is ``fundamentally too high,'' Lowe said.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.