- Home

- >

- FX Daily Forecasts

- >

- Morgan Stanley for the Australian dollar…looks weak (sell AUD / JPY)

Morgan Stanley for the Australian dollar...looks weak (sell AUD / JPY)

This is the weekly MS analysis of currencies from the end of last week. Quick comment on AUD and proposal.

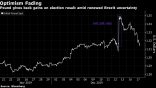

Decreasing yields and interest rate differences are counter to the growing need for foreign financing. So far, Australia has overcome this gap by increasing share flows. This strategy works in times of rising appetite for risk. However, the differences in interest rates are smaller and Australian asset ratings are increasingly dependent on foreign flows. As a result, AUD may fall faster than before when it reduces appetite for risk.

That RBA goes to neutrality changes the game for AUD. The conditions in the economy are falling.

The high debt of households reduces workers' appetite for aggressive demand for higher wages. This low-inflation dynamics can be boosted when real estate prices start falling, reducing the net wealth of households.

We offer a short AUD / JPY

The risk for this deal is that global central banks are becoming majestic while global growth slows down but develops a synchronized model. In this case, Japan can continue to transfer funds abroad and Australia can find it easy to attract capital flows. However, we believe that the likelihood of such a result is minimal. In the absence of rising factor productivity growth, the acceleration in G10 wage inflation implies either higher inflation or lower corporate profits, which is not in favor of global risk.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.