- Home

- >

- Market Rumours

- >

- Morgan Stanley: The moment of truth for the stock market is here

Morgan Stanley: The moment of truth for the stock market is here

Corporate earnings are starting to roll in, and Morgan Stanley's chief US equity strategist is warning that it's a do-or-die moment for the stock market.

Considering the S&P 500 has already soared 15% this year, Mike Wilson says Wall Street will want to see clear signs that growth will pick up in the months to come. And if that evidence doesn't materialize, he thinks stocks are going to struggle.

"Earnings season offers a gut check for a market looking for some evidence that the worst is truly behind us," he wrote in a note to clients. "The moment of truth is here."

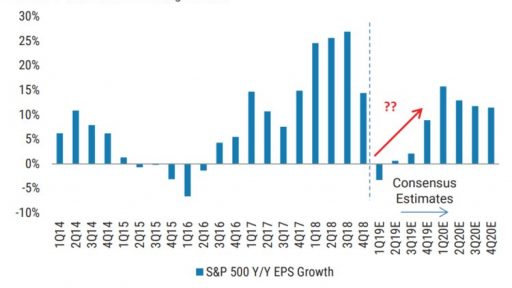

Experts are predicting a small dip in earnings in the first quarter, much of which they're pinning on temporary obstacles like the partial government shutdown. There's also the matter of the abnormally large profit growth companies enjoyed in the first quarter of 2018, when the GOP tax plan was still generating gobs of fresh capital. That makes any year-over-year comparison a difficult one.

But it's what happens next that has Wilson thinking differently than most other experts. And his argument is built around company forecasts, which he says will be critical.

"If we don't get the reacceleration now baked into the consensus expectations, it will be treated as a disappointment by investors," he wrote.

That's one reason he expects the S&P 500 to finish the year at 2,750, about 5% lower than it is right now.

Wilson has consistently been more pessimistic than most people on Wall Street. While analysts think profits will start growing again in the second quarter and wind up with growth of about 5% this year, Wilson expects an "earnings recession," meaning at least two quarters of flat or negative earnings growth.

Earnings consistently come in better than analysts expect, which might create some hope that profits will end up a bit better than the first quarter of last year. Wilson warns investors not to expect that because estimates have fallen so sharply. When that happens, he said, companies typically don't beat expectations by very much.

Source: BI

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.