- Home

- >

- Market Rumours

- >

- Morgan Stanley: The stock market correction isn’t over as evidence shows

Morgan Stanley: The stock market correction isn't over as evidence shows

The stock market correction likely isn't over, and evidence is mounting that there is more downside risk ahead for investors, according to Morgan Stanley.

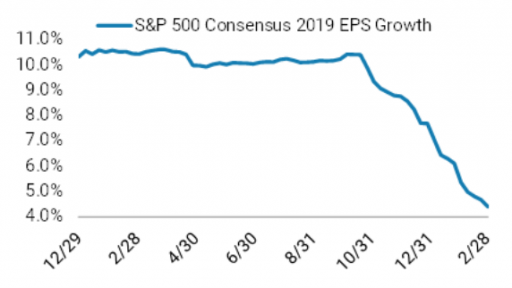

The investment bank projected that full-year earnings per share forecasts for S&P 500 companies are likely to further fall between 4 percent and 5 percent, which could put added pressure on the index. The S&P 500 has gained more than 17 percent since hitting a 52-week low on Christmas Eve, boosted by progress in U.S.-China trade negotiations and signs that the Federal Reserve will continue to be patient on any future interest rate hikes.

But forecasts for 2019 S&P 500 earnings per share growth are already down 6 percent from their peak in September, and Morgan Stanley thinks investors aren't out of the woods yet.

"Earnings revision breadth has been some of the worst we have ever witnessed with both sales and margin guidance coming down across all sectors," Morgan Stanley's chief U.S. equity strategist, Michael Wilson, said in a note. "The earnings recession is real and broader than the one we experienced in 2015-2016. It's also happening at a time when the economy has much less slack."

Two recent economic data points last week amplified those concerns. Job cuts surged in February to the highest monthly total since July 2015, followed up by U.S. government employment data that badly missed expectations. Nonfarm payrolls increased by just 20,000 in February — the worst month for job creation since September 2017.

"We think it is likely this gets worse before it gets better given the downward adjustment to earnings forecasts we expect," Wilson said.

Recent data suggests that economic weakness outside the U.S. could pose yet another threat to earnings for U.S. companies. Those international-facing companies, generating more than half of their sales overseas, are expected to see an earnings decline of 11.2 percent in the first quarter of 2019, according to FactSet.

That is significantly lower than the earnings estimates for the S&P 500 and for domestic-oriented companies. Wall Street is projecting a 3.4 percent earnings loss for the S&P 500, while seeing 1 percent growth for companies with more than half of their sales coming from the U.S., according to FactSet.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.