- Home

- >

- Daily Accents

- >

- Most of the US indices closed lower today, except DJIA

Most of the US indices closed lower today, except DJIA

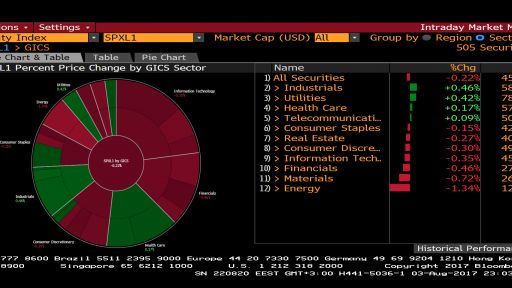

American stocks closed slightly lower today, except DJIA, as the index NASDAQ closed with most loss. Dow Jones climbed over 22,00 points and added to it today 10 more points, after the better than expected financial results from Apple. Fundamentally, the economy is well but there are some indicators that can spell slowing growth. Investors are careful as they are expecting the most important news of the week, the NFP/Non-Farm Payrolls report tomorrow, with expectations of 183К and the Unemployment rate will be carefully watched by traders. These numbers are directly tied to the next action that FED will take in regards to the interest rates and normalization of its balance sheet. The turmoil in Washington is still present in regard to the Trump campaign staff and Russia.

DJIA: 9.86 points/ 0.04% - 22,026.10

S&P: -5.41 points/ -0.22% - 2,472.16

NASDAQ: -22.30 points/ -0.35% - 6,340.34

RUSS 2000: -7.92 points/ -0.56% - 1,404.98

VIX: 10.44

For the S&P higher were the Industrial sector and Utilities stocks. Most negative reading was from the Energy sector by -1.34%

For Dow Jones higher were traded Pfizer and GE

Telsa was traded higher by 6.5% for the NASDAQ index, after it reported less than expected loss.

The price of Oil fell to $48.85 per barrel, due to the higher USD, but the tendency remains for higher prices in the short term. Some of the analyst call for the price to move higher but remain below the $60. The USD did stabilized for a moment but then it fell again, as the USD/JPY was trading lower at 109.900. Our expectations remain negative for the USD in the short term. The Euro was trading higher again as we expect it will continue to go higher and reach the $1.20 level.

Source of the graph: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.