- Home

- >

- New Technologies

- >

- New market volatility index

New market volatility index

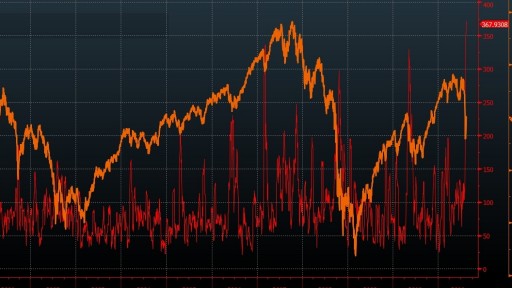

A new market-volatility gauge is aiming to be less volatile than its main rival.

Exchange operator Bats Global Markets and indexing firm T3 Index on Tuesday launched a volatility index that will compete with the market’s main “fear gauge,” the CBOE Volatility Index. While these indexes aren’t traded, investors refer to the CBOE Volatility Index, or the VIX, as a quick way to quantify U.S. stock-market volatility, especially during tumultuous periods.

The new gauge, the Bats-T3 SPY Volatility Index, or SPYIX, is a response to the market’s “demand for a more rigorous and dependable volatility gauge,” said Tony Barchetto, head of corporate development at Bats, in a news release.

The SPYIX is based on prices of SPDR S&P 500 exchange-traded-fund options, compared with the VIX, which is based on S&P 500 options prices. Both measure expectations for stock swings over the next 30 days. Bats and T3 say the use of the mainly electronically traded SPDR S&P 500 ETF options is an improvement over predominantly floor-traded S&P 500 options, and that the calculation of their index includes features that will “reduce erratic movements in the index” during times of low liquidity.

They cited Aug. 24, when the VIX wasn’t calculated for about a half-hour amid extreme swings in stocks. They say they were able to calculate SPYIX during that time, even though the values weren’t disseminated to the public.

“It’s not unusual to see competition when you have a successful product,” said Bill Speth, vice president of research and product development at CBOE, in an emailed statement. The VIX has inspired a slew of copycats over the years.

SPDR S&P 500 ETF options were the most traded U.S.-listed options in each of the last 10 days through Monday, according to options-data provider Trade Alert. On Tuesday, those options were on track to post the highest volume, followed by VIX options and S&P 500 options.

“If you have something that works, why change it,” said Wayne Wu, who trades SPDR S&P 500 ETF options on the NYSE floor for Integral Derivatives. He added that SPDR S&P 500 ETF and S&P 500 options are “really the same thing.”

The VIX was introduced in 1993 and now has futures, options and a slew of exchange-traded products tied to it. The Nations VolDex is another gauge of volatility that measures expectations for swings in the SPDR S&P 500 ETF, though it’s not widely used.

“It typically takes some time for any new index product to get mass acceptance,” said Steve Sosnick, an options trader at Timber Hill, the market-making arm of Interactive Brokers.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.