- Home

- >

- Stocks Daily Forecasts

- >

- Nobody wants to use the ‘B’ word, but a bubble is upon us

Nobody wants to use the 'B' word, but a bubble is upon us

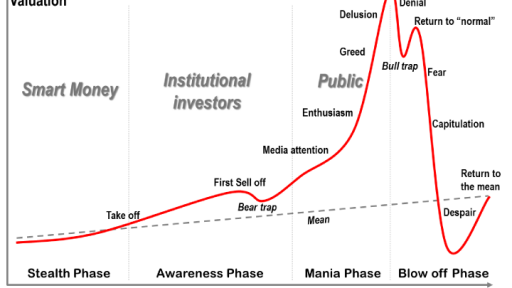

Nobody wants to use the 'B' word, but a bubble is upon us, a growing number of market watchers are warning.

And it could pop sooner than many expect, Centricus Asset Management Fund Manager Ralph Jainz said, joining a long list of financial players casting doubt on the strength of the market's current bull run.

"Nobody wants to talk about this being a bubble. It's the greatest asset inflation bubble we have seen in 20 years," Jainz said."

There is wide disagreement over whether markets have further to climb or whether we'll see a spectacular market correction. Investing titan Mark Mobius recently predicted an impending correction of up to 30 percent, while others see no cause for concern.

But assets like tech equities have hit their highest points ever this year, and because of this, Jainz explained, traditionally defensive stocks like healthcare, pharmaceuticals and telecommunications are losing out. And these are exactly where you'd want your money to be in the event of a downturn, which Jainz believes may be just a year away.

"Dispersion levels have been rising, people have been selling the losers to buy the winners," the fund manager said, describing stocks that were already expensive becoming more expensive — like those in tech — as buyers rush to those out-performers and in turn sell the underperformers.

"Now the underperformers are exactly the sectors you will need to protect you when the next cyclical downturn actually comes along, which is probably the case in the next 12 to 18 months."

Tech stocks have become so expensive, according to some investors, that many believe they no longer have room to grow. Still, this isn't a total consensus, as money keeps pouring into large-cap leaders like Netflix and Amazon, up 104 percent and 46.7 percent year-to-date, respectively.

Meanwhile, the underperformers that Jainz described — like the S&P's telecoms and healthcare indexes — are down 11.4 percent and up a mere 3.51 percent year-to-date, respectively. Information technology is up 14.1 percent on the year.

"You normally need a generation to come along, a new generation to make the same mistake that we all did 20 years ago," Jainz added. "And I probably won't see another one until I retire in 20 years' time." But too many people, he warned, are selling off the safe sectors that could serve as a much-needed haven later down the road.

Recently, Fasanara Capital, a London-based asset management fund, predicted a full-on crash ahead, citing increasing frequency of value-at-risk shocks — or swift market corrections — as an indication of fragility for global markets. Fasanara also accurately predicted the market correction in early February, saying just two weeks before that stocks were long overdue for a re-pricing.

But many still conversely are optimistic about the markets. Credit Suisse said in a note last week that there are "clear signs that economic growth is set to accelerate across major regions in the second half of 2018, creating a favorable climate for equities and certain commodities."

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.