- Home

- >

- FX Daily Forecasts

- >

- NZD: In a Holding Pattern and still Oscillating: Where to Target? – ANZ

NZD: In a Holding Pattern and still Oscillating: Where to Target? - ANZ

Lacking firm directional signals globally, the NZD remains in a holding pattern.

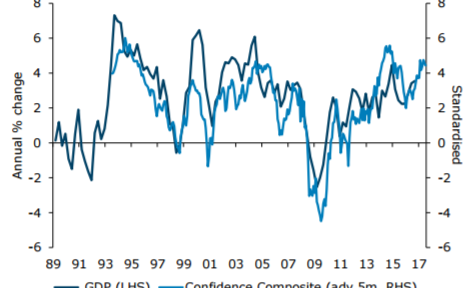

Prime cadidates fro a turn include the liquidity cycle or a liquidity-driven event, though at present it is difficult to identify both timing and the specific catalyst. The combination of a moderation in cyclical components of the New Zealand economy (housing, building consents) and the firm and timely reminder from the RBNZ that the currency does matter for its inflation profile and hence delayed tightening cycle has been enough to dent the NZD strength. Could this extend into protracted weakness? We think the short answer is no, for several reasons:

We don't think the domestic growth picutre is weakening -growth is moderating as capacity constraints bite not because of softening demand.

Commodities remain buoyant

Core and headline inflation is picking up;with that comes the bias for higher rates. The RBNZ flagged a 2019 start to the tightening cycle;that's way too far off for markets, who expect hikes sooner

Political stability is apparent

Fiscal credentials are strong

Lacking a firm domestic driver to dictate direction, we remain focused on international forces.

ANZ targets NZD/USD at 0.72, 0.70, 0.69, 0.68 by the end of Q1, Q2, Q3 and Q4 respectively.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.