- Home

- >

- FX Daily Forecasts

- >

- NZD/JPY – Opportunity for Short Positioning with Trend

NZD/JPY - Opportunity for Short Positioning with Trend

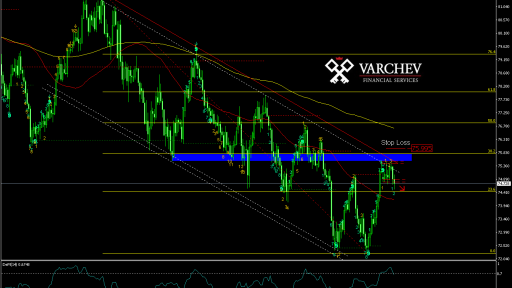

NZD/JPY - Daily

Our expectations: Long-term downward trend and price after correction to main resistance zone. SL: 75,995.

Alternative Scenario: If the price moves above the resistance zone, the negative scenario will be spoiled and more likely to see a rise in the pair's price.

Commentary: The price has reached a zone of resistance after a short-term consolidation period accompanied by strong Price Action in favor of bears. The resistance zone is formed by a downward diagonal, horizontal resistance and 38.2% Fibonacci on the main trend. 50 and 200SMA are swinging - the trend remains in place. From the point of view of the indicators, DeMarker 14 is in the over-buying area and points down - negative for the price. Sequential counts down 2 - the price is in the downstream wave.

Positioning - For better positioning I will use H4. After the price goes out of consolidation, we are witnessing a lower limit test. The positioning options are currently two. Now, with a small volume and a distant stop (75,995) and after eventual re-entry into the range, testing the main diagonal.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.