- Home

- >

- FX Daily Forecasts

- >

- NZD/JPY – Short opportunity during Asia trade session

NZD/JPY - Short opportunity during Asia trade session

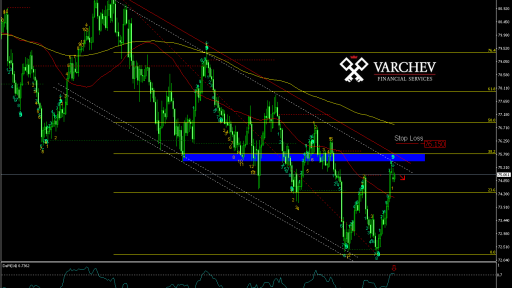

NZD/JPY - Daily

Our expectations: Long-term downward trend and price correction to key resistance, giving the opportunity to Sell with stop at 76.15.

Alternative Scenario: If the price goes above the resistance zone and is able to hold on to it, the negative scenario will break and we are more likely to see a kiwi rise against the yen.

Comment: The price is in a resistance zone formed by a major downward diagonal, a horizontal resistance zone and a 38.2% Fibonacci correction of the main trend. In support of Shorts are also the moving average, 50SMA remains below 200SMA - the trend is in effect. DeMarker is in the over-buy zone, pointing down, the probable end of the corrective impulse. Sequential counts the 9th and top arrows, signaling the end of the upward pulse and a likely twist of short-term downward movement. Price Action: The couple started the week in a downward direction, which was filled yesterday. After filling the gaff, the price forms a daily bearish pin bar at levels of resistance that is currently being tested and gives a good positioning position with a short Stop Loss Order. At input from current levels, the risk/return ratio remains 1:3, despite the remote SL.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.