- Home

- >

- FX Daily Forecasts

- >

- NZD/USD 4-Hour Breakout Could Be In Play

NZD/USD 4-Hour Breakout Could Be In Play

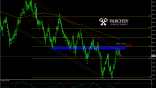

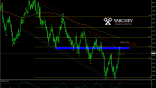

The New Zealand dollar has been roaring lately as the pair has reacted strongly to the diminished sentiment for the greenback. Subsequently, the pair has risen from a low around the 0.72 handle to form a new high around the 0.7549 mark. This is not an inconsequential rally but the air might finally be evaporating from the bullishness as price action pulls back sharply in response to renewed interest in the greenback. So the Kiwi's future remains uncertain as the pair now prepares for a 4-hour range breakout.

In particular, a cursory review of the 4-hour chart highlights the pair’s current conundrum with price action having declined overnight following the upgrading of the U.S. Fed’s Atlanta GDPNow estimate to 2.8%. This subsequently had a bullish impact on the greenback and has seen a significant sentiment swing in play.

Subsequently, price action appears to have now formed some intra-day support around the 0.7480 mark and looks to be setting up for a breakout of the current range. In addition, the RSI Oscillator has also started to trend in a bearish direction which has helped to relieve the pressure and the indicator is now trading within neutral territory.

In addition, the RSI Oscillator has also started to trend in a bearish direction which has helped to relieve the pressure and the indicator is now trading within neutral territory.

Subsequently, there is something brewing for the pair and the present sideways direction could lead to a breakout/down of the range in the coming days. In fact, there are two potential scenarios for the pair with a breakdown likely to see price action declining back towards support at 0.7419. In the alternative scenario, price action could gather steam in a sideways fashion and then break sharply towards resistance at the 0.7558 mark.

Either of these scenarios is equally likely given that price action is presently resting right at the center of the range. However, my personal view is that the risks are currently slanted to the downside given the meteoric rise that the NZD has experienced lately. Subsequently, in my view, the most probable move is a downside push towards support at 0.7418.

Source: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.