- Home

- >

- Commodities Daily Forecasts

- >

- Oil Bulls Exit Before Market Dive on Swollen U.S. Stockpiles

Oil Bulls Exit Before Market Dive on Swollen U.S. Stockpiles

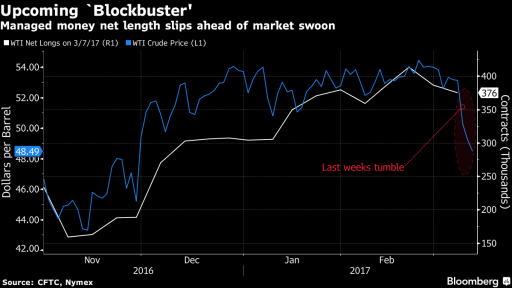

Oil’s fall from grace last week started with hedge funds, and it may only get worse from here.

Investors cut bullish wagers on West Texas Intermediate crude to a one month-low, according to U.S. Commodity Futures Trading Commission data, a move that came just prior to a market dive that sent prices below $50 a barrel for the first time since December.

"This report is just the beginning," said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. "The volume and breadth of the decline this week show that there was massive liquidation. Next week’s report will be the blockbuster."

Optimism about an agreement between the Organization of Petroleum Exporting Countries and some non-OPEC producers to cut output is fizzling as stockpiles continue to climb and U.S. drilling rigs are returning at the fastest rate since 2012. The fall in oil prices, which had traded between $50.50 and $55.24 since Dec. 16, helped drag the S&P 500 to its first weekly decline since January. WTI on Monday traded down 0.9 percent at $48.08 a barrel as of 12:38 p.m. in Singapore.

The market’s volatility surged the most since before the 2014 price crash started after a government report showed U.S. inventories reached a record. The gains since OPEC agreed to cut output at the end of November were wiped out. The rout accelerated Friday after Baker Hughes Inc. data showed American shale explorers keep adding rigs.

Hedge funds trimmed their WTI net-long position, or the difference between bets on a price increase and wagers on a decline, by 2.9 percent in the week ended March 7, following a 6.5 percent drop the previous week, according to the CFTC. The net-long position dropped by 11,149 futures and options to 375,558, capping the first two-week decline since November. Longs slipped 2.5 percent, while shorts advanced 0.5 percent.

"There’s been a loss of confidence," Evans said. "The fourth consecutive U.S. crude inventory record might have helped send them for the exits and the admission of Khalid Al-Falih that inventories weren’t falling as much as anticipated also caught their attention."

U.S. crude stockpiles rose to 528.4 million barrels in the week ended March 3, the highest in weekly data going back to 1982, according to an Energy Information Administration report on March 8. Crude production rose to 9.09 million barrels a day, the highest since February 2016. The nation’s active oil-rig count has almost double since May to 617 last week, according to Baker Hughes Inc.

Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.